My Story

They say that building a dream out of ashes is possible, but only for those with passion. From my own beginnings, I knew that I had a passion for the goals that I had; I knew that in time I would thrive.

I started my early ventures with a job in electrical engineering during the great recession. While this job assisted me in learning the basic skills that I needed to survive, it did little to help me to better my way of living. Without proper assistance in financial education, I grew to have a very minimal understanding of saving. Instead of setting my income aside for emergency funds and personal payments, I spent a considerable amount on airline tickets, new gadgets, and Lightsabers—yes, Lightsabers. I’m a total geek.

Soon enough, the time came for me to look to purchase my own home. At the time, the cost of rent was nearly the same as potential mortgage payments; I felt ready for my first big investment. The topic that stopped me dead in my tracks? Debt. In all of my time spending my money on new and exciting trips and toys, I put myself in the improper financial position that I needed to be in to purchase a home. Doing what I could at the time, I moved some money around and put a hold on my spending here and there; finally, I was able to purchase my first home. It’s a great feeling to have for such an accomplishment; however, my journey wasn’t over quite yet.

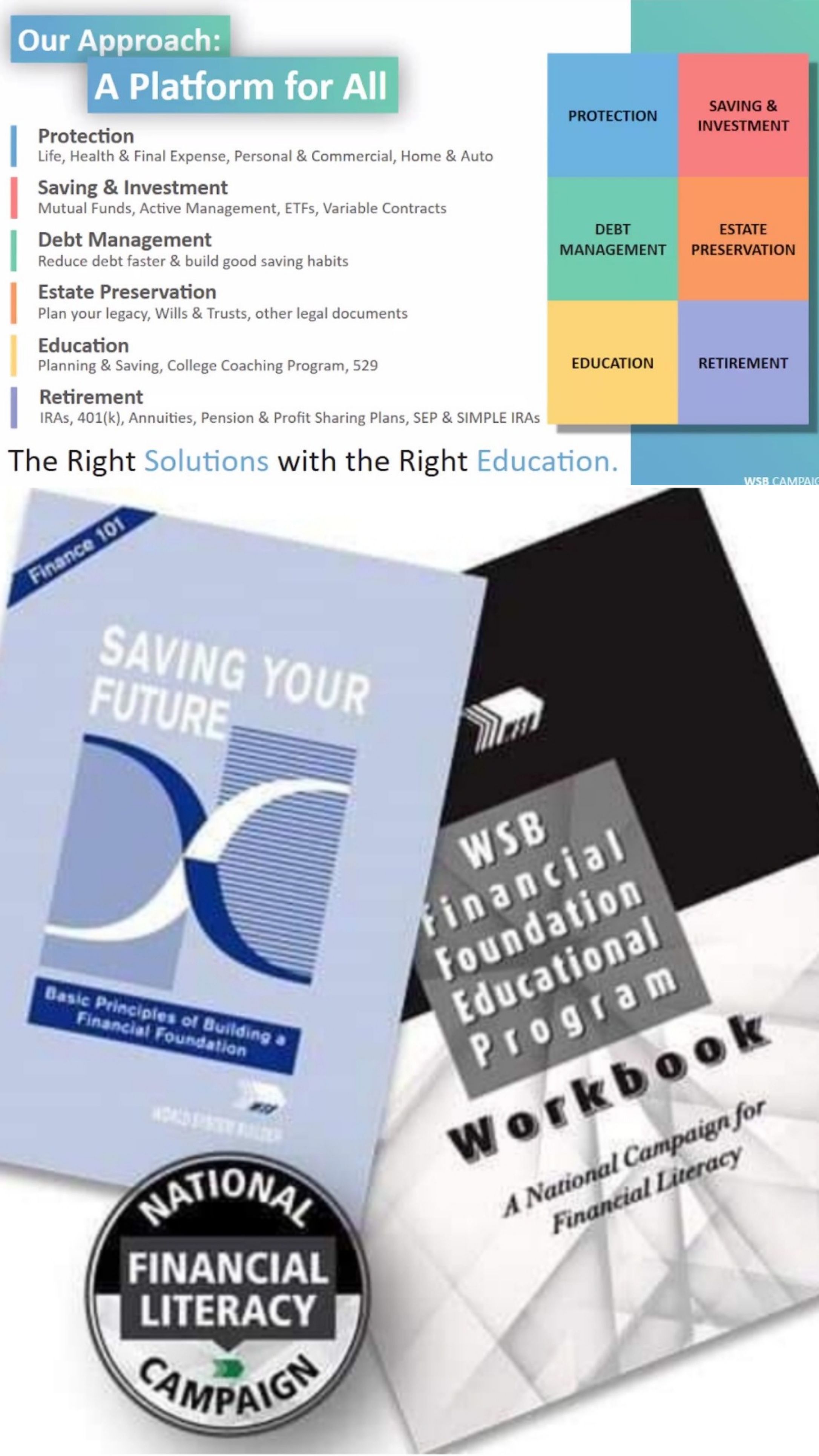

I first heard about World System Builder through the financial workshops that I attended after being invited by my aunt. From that point, I decided that joining the Social Enterprise was my ideal next step. While my aunt’s intentions were great, I was never truly in the right mindset to be active in business. Months passed and my sister involved in personal growth invited me to her business—the same operation that my aunt is in. Their campaign banner stood out to me, “1 Million Financially Educated Families by 2020.” At that point, I was shocked to learn that my mom was also in the enterprise just 10 years prior. Even today, she continues to be financially educated in all of her ventures. Because of the fantastic financial education that my family was able to receive, each of my family members has been able to live without financial worry.

Today, my debt is well managed. I know exactly where my money should go and what I should be investing in and saving for at all times. Because of this financial education, I don’t have to worry about the what-ifs in life. If the stock market were to crash, if a family member needed assistance, or if there were some emergency that required financial attention, I know that I am prepared. I am able to save $1800 a month to contribute to my financial protection, pay off debt, accumulate emergency funds, investments, and have extra funds on the sides. No matter where life takes me, I know that I’m financially ready for it.

Because of this financial stability that I have been able to secure for myself, I was moved to share this financial education with every individual that I possibly can. That goal of 1 Million Financially Educated Families by 2020 has been reached, so we are moving up toward an even greater goal of 30 Million Financially Educated and Empowered Families by 2030. With the right guidance and education on saving, investing, and securities, we have the ability to Build it BIG.