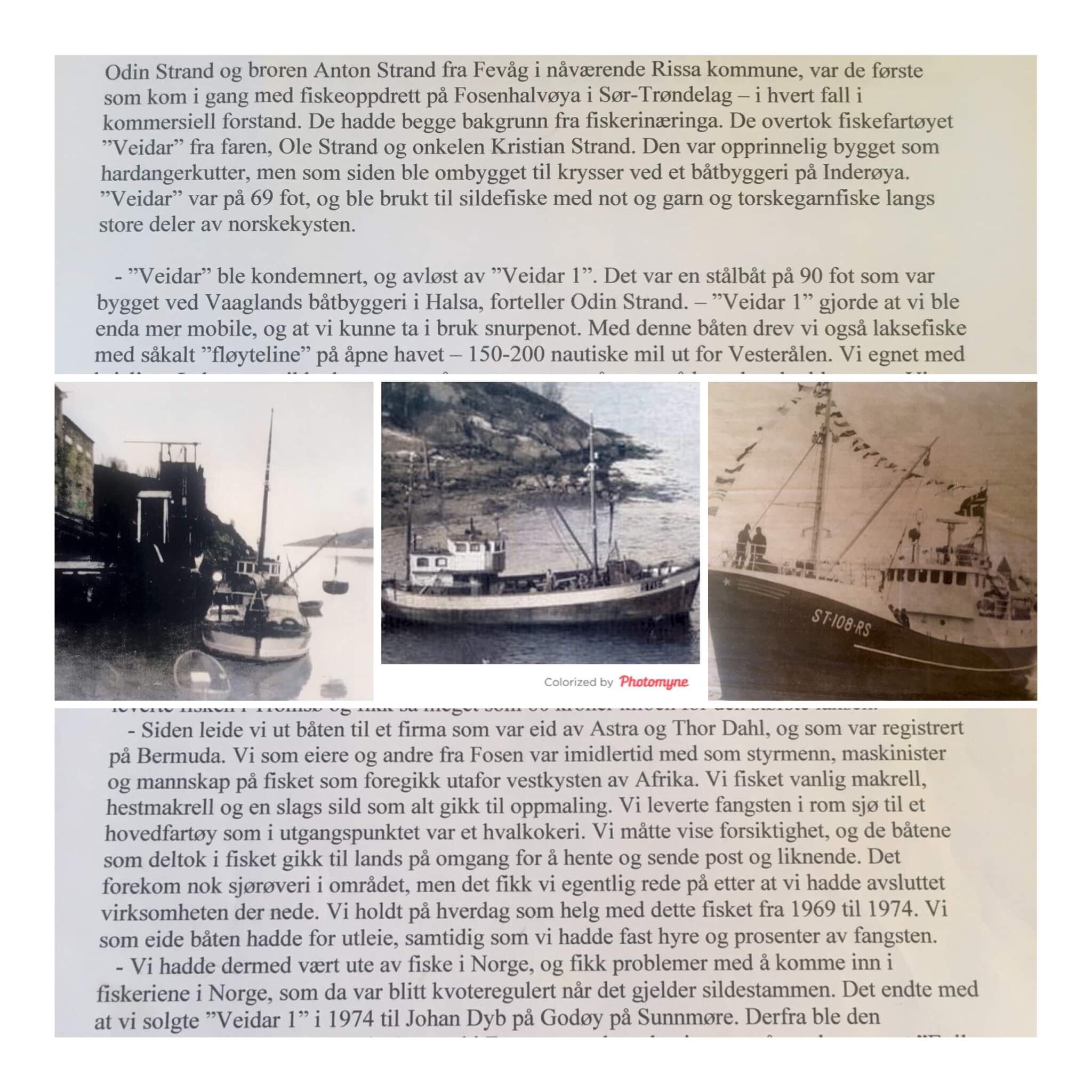

Many thanks for the hosting of our great Company Tour at Seattle Fish Company om March 30th 2019, we highly appreciate the courtesy of two fine representatives of the jubilee celebrating company with sales distribution Denver plus Kansas City 2019.

Director Mr P.J. Paland

Quality Supervisor Mr Eric Floyd

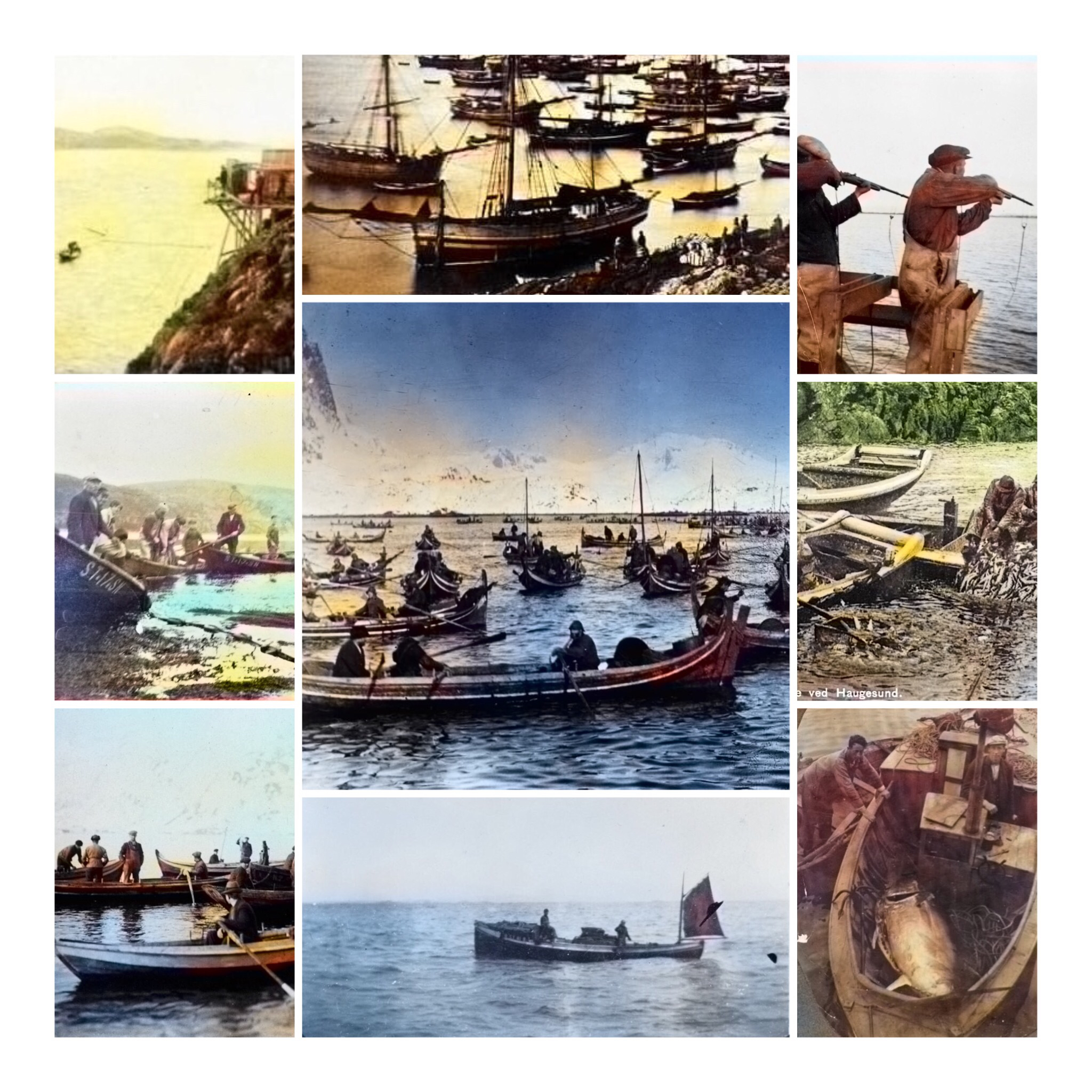

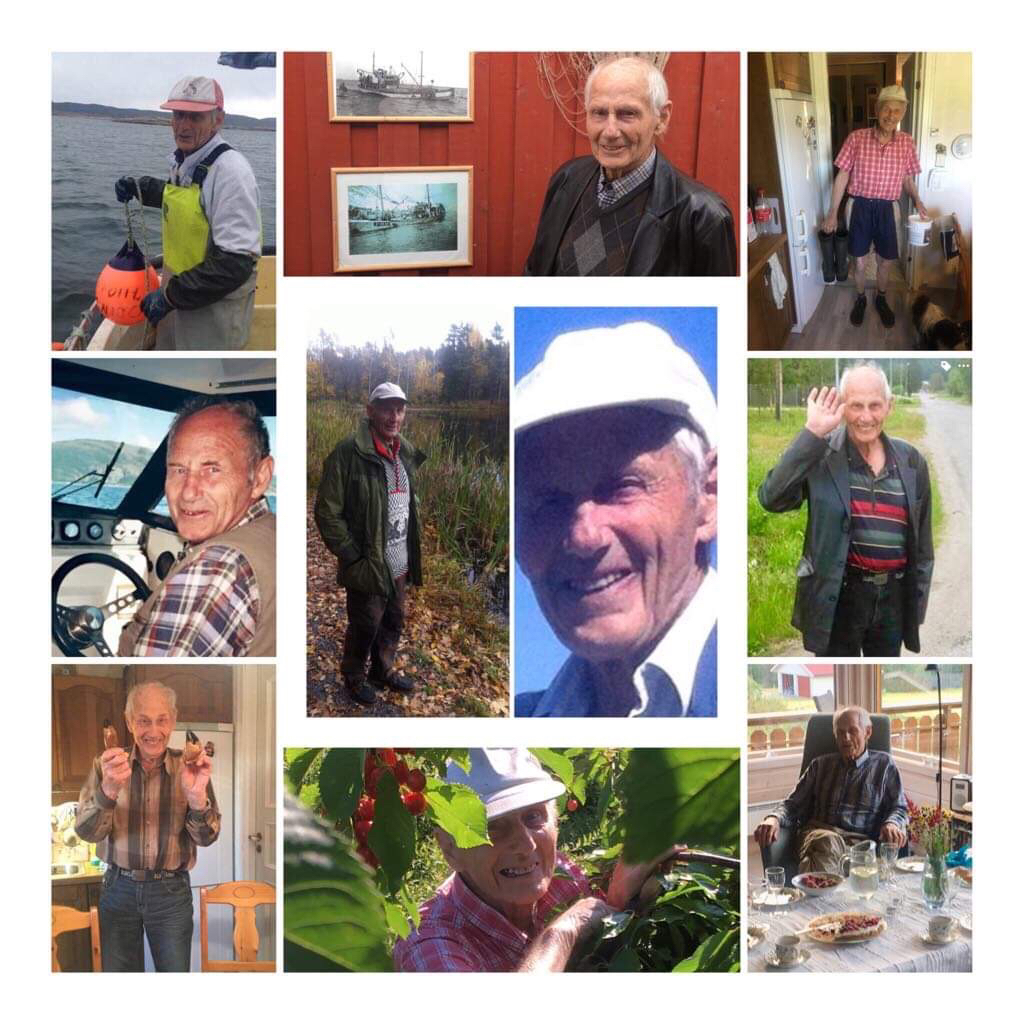

On behalf of Mr Halvor Leithaug Strand

Mr Odd Sverre Strand

Halvor Leithaug Strand: 2017 Gold in NM Seafood Trader Sjømathandel, Fiskeansvarlig Meny Rykkin near Oslo Norway, 2017 featured in a Chef magazine and a 2017 Grand Tour at Lofoten Norway and pt a 2019 Tour at Seattle Fish Co Denver.

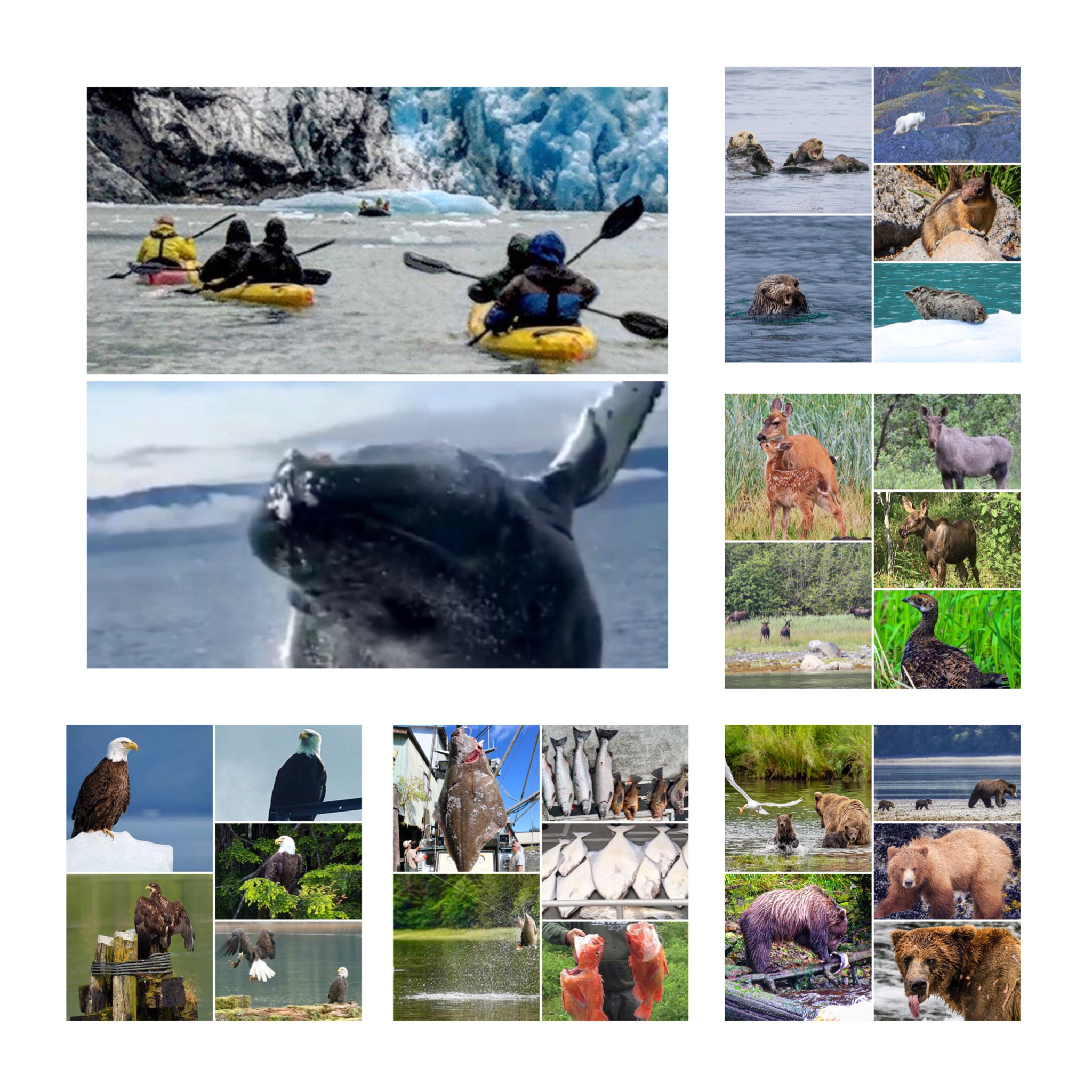

Locally Committed Chefs AND Green rated seafood

«Once chefs realize the power that they have in putting pressure on the suppliers to provide green rated seafood items, that’s really when the system is going to change.»

– Sarah Drew

JBF has long included Denver chefs in their various programs, including their Bootcamp for Policy and Change. Miller explained the foundation’s desire to host a Sustainable Seafood Summit in Denver, “It’s a place where we know that chefs are really interested in being better food system advocates and certainly in a place where the issues related to sustainable seafood especially around high-quality aquaculture and mariculture are important because it is a landlocked state, with the exception of rivers and lakes.”

It’s true – the foundation is currently onboarding 10 Denver chefs for the Smart Catch program after the meetings in October, in addition to some chefs who are already part of the program and others who are looking to join soon. Impact Programs Manager for JBF, Sarah Drew, explained the importance of the Smart Catch program in a food-oriented city like Denver. And chefs in Denver are taking note.

Jeff Osaka of 12 at Madison, Osaka Ramen, Tammen’s Fish Market and Sushi-Rama prefers to use the phrase “responsible purchasing” when it comes to sourcing seafood for his restaurants. He focuses on the methods used to source and how fish is farmed, harvested or caught when making decisions. “We buy from a reputable source, Seattle Fish, so that takes a lot of the weight off of us. But we also have the responsibility to ask them questions as well.” As a JBF Bootcamp for Policy and Change attendee, Osaka recognizes the influence he has on consumers in Denver. Changing menu items to reflect more sustainable fishing and farming practices clues in consumers to make more conscious decisions in choosing what to order at a restaurant or buy in the grocery store. Osaka expressed his hope to educate his customers more on seafood. Tammen’s in Denver Central Market operates as part restaurant and part fish counter. Though only about 20 percent of the business is selling out of the retail case, he anticipates more consumers looking to buy fresh fish.

«A lot of people are afraid to cook seafood,» he commented. Increasing the retail side is “about educating and having a connection with our customer,” teaching them how to cook different types of fish. Sheila Lucero with the Big Red F Restaurant Group is learning a lot about cooking different species of fish herself. As a leader in Denver’s seafood industry, she has been the executive chef of Jax Fish House & Oyster Bar since 2009 and recently took on the additional role of executive chef position at Lola Coastal Mexican. There, she’s learning about a new genre of seafood cooking traditions and working with new species of fish.

Though she expanded her repertoire, Lucero hasn’t backed down on her sustainability mission. The chef sources from certified sustainable fisheries and farms and is excited about a few new fishing innovations. One of her new favorite products is processed and frozen at sea. This method eliminates waste and allows for a fresher taste – fishermen typically freeze their catch at sea and are then thawed to be processed on land before refreezing for transportation and distribution.

The Blue Ribbon Task Force by the Monterey Bay Aquarium

One of about 60 chefs across the US, Lucero is a member of the Monterey Bay Aquarium’s Blue Ribbon Task Force. These leaders meet a couple times a year to discuss healthy ocean sourcing and brainstorm methods to be better seafood advocates. Last year, Lucero traveled to the nation’s capital to speak on behalf of the seafood industry. Along with two other chefs – one from Florida and the other from California – Lucero defended the current Magnuson-Stevens Fisheries Conservation and Management Act. Amended in 2006, the act has enabled the United States to have some of the best-managed fisheries in the world. The current proposed changes would weaken the act’s strong sustainability measures. Lucero explained, “a lot of the congressmen [were] really surprised to see me – to go all the way to D.C. to talk to them about our oceans, but I’m from Colorado.” Though Congress has not yet made a decision on amending the Magnuson-Stevens Act, Lucero knows her advocacy has opened the eyes of the political leaders. “They were just really interested in how this affects people in the middle of America,” she added.

Lucero understands that in order for the trend in sustainability to continue, people from all parts of the country need to advocate for positive changes. It is just as important for consumers in the middle of the country to be educated on the state of the fish stocks and the importance of sourcing sustainably. “I do feel fortunate living in Colorado that there’s consumer mindfulness more. And more people like knowing where their food is coming from, and they like knowing they can trust us,” Lucero commented. This trust runs deeper than the expectation of a delicious meal – more and more Denver consumers recognize the effects of the food they eat.

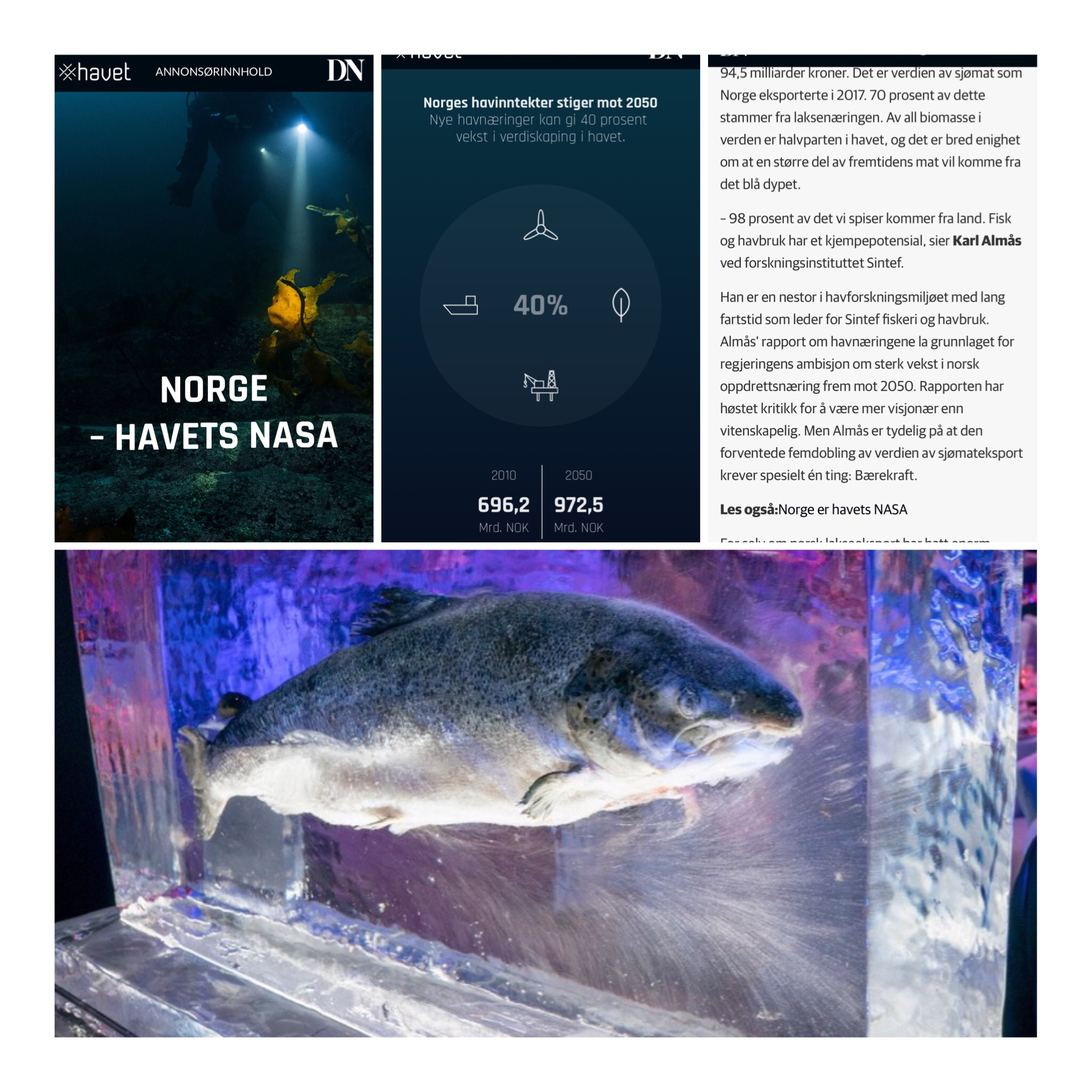

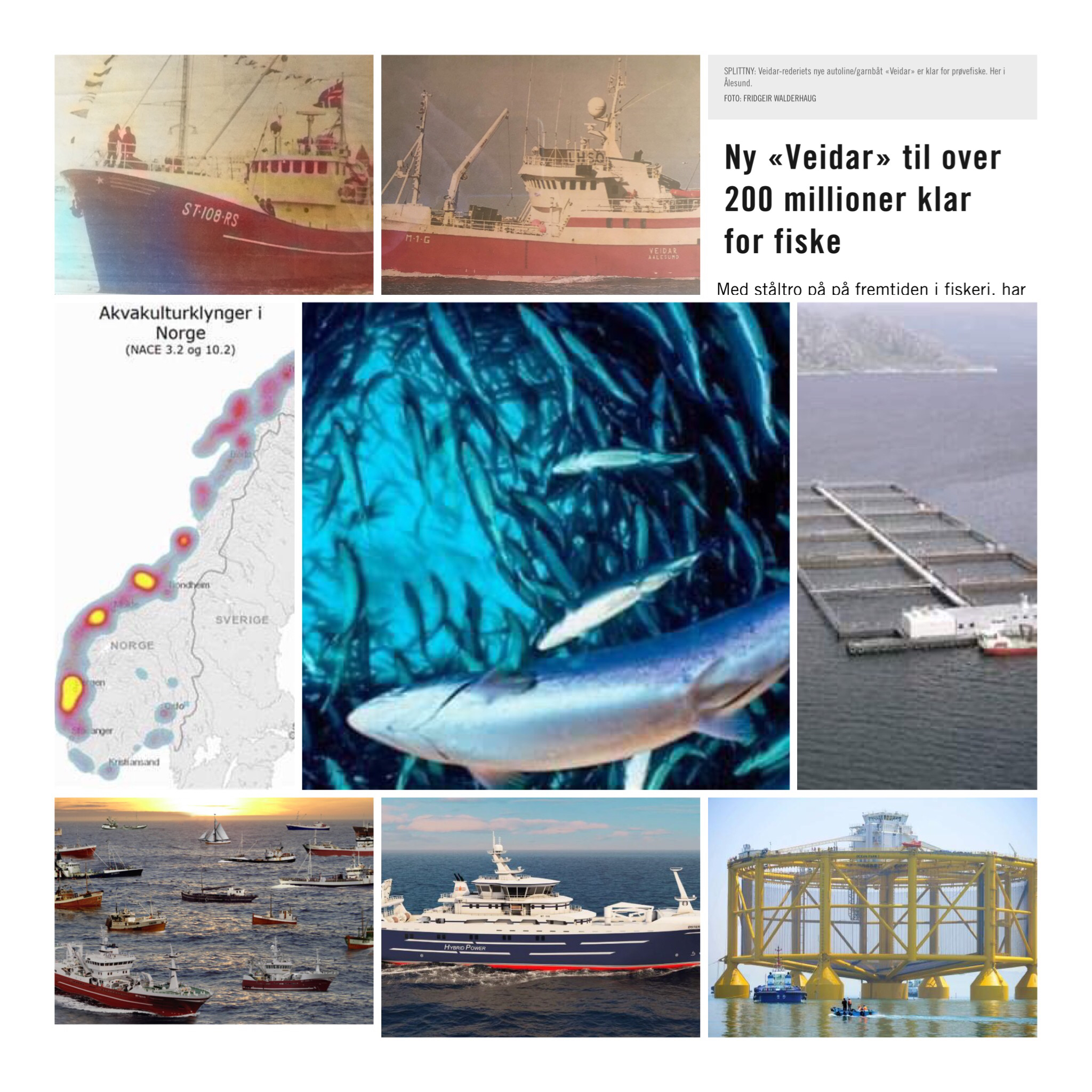

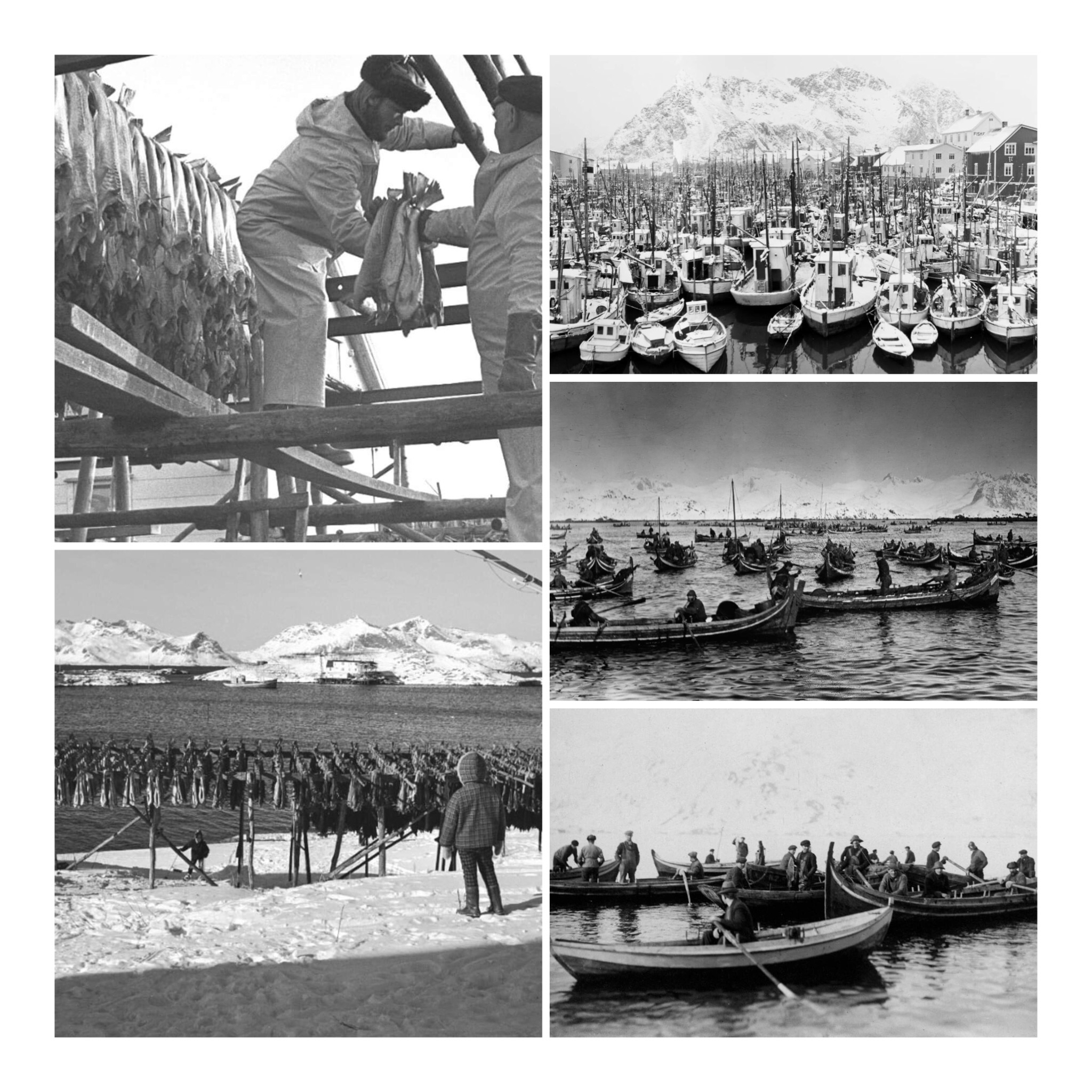

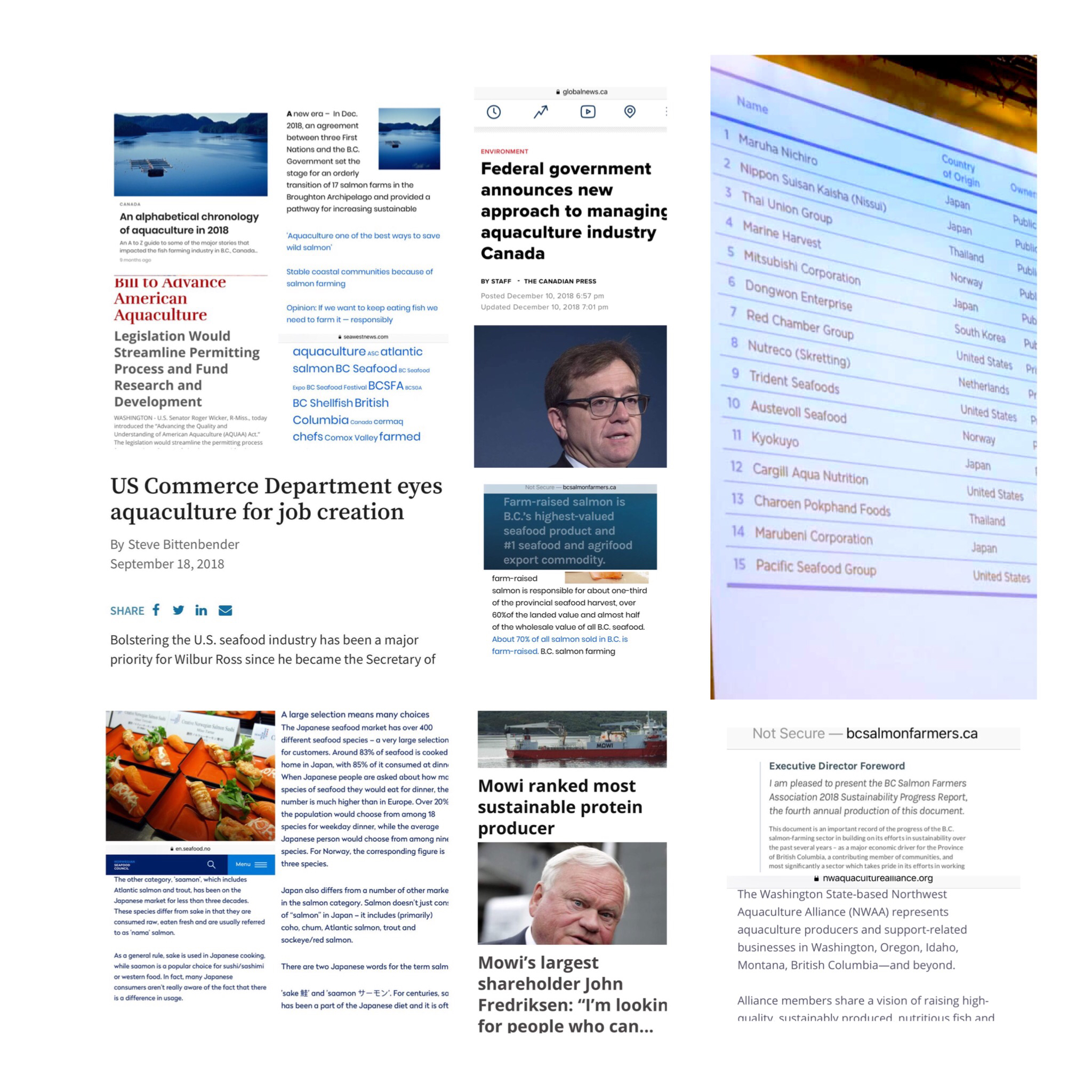

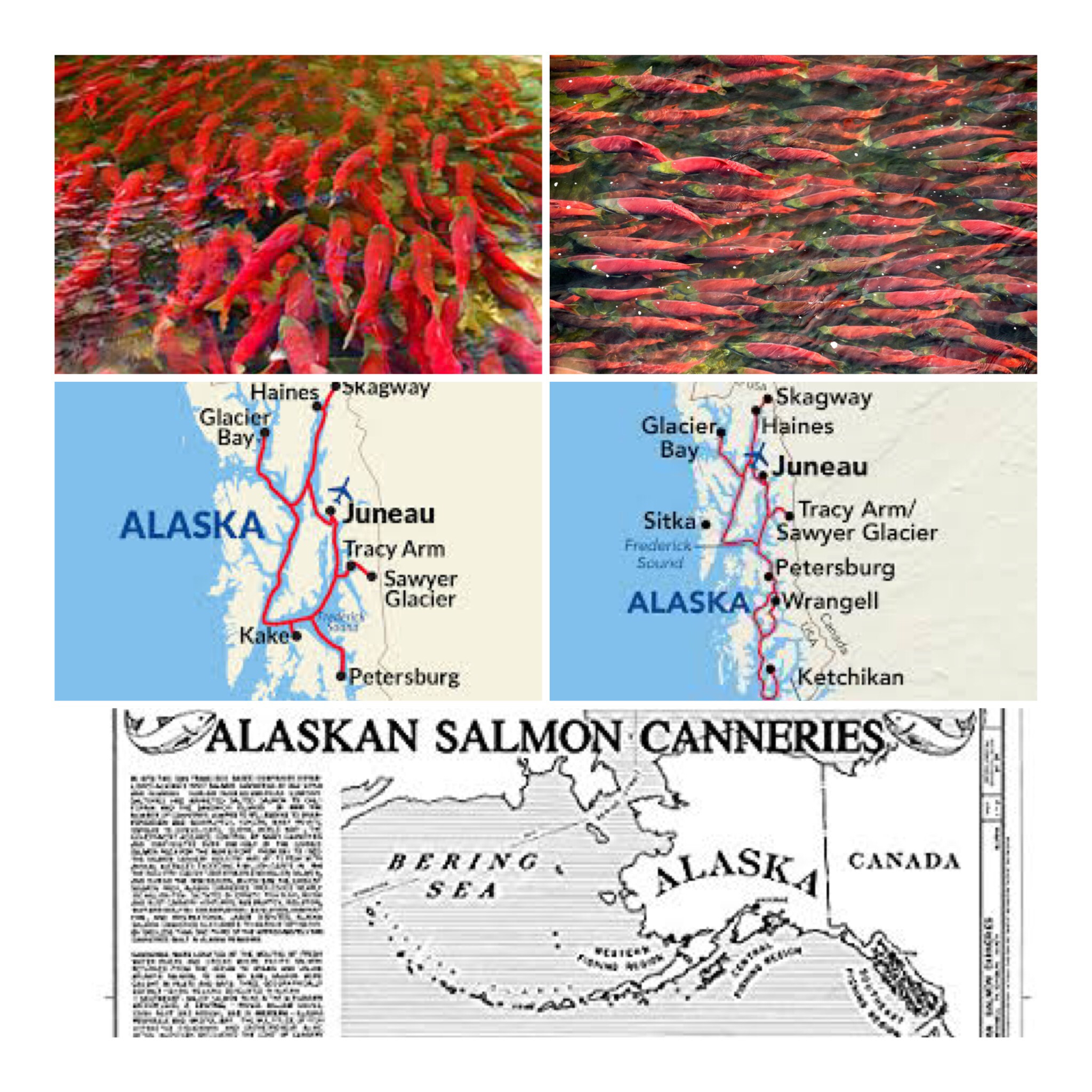

The US is a major importer of seafood

To meet consumer demand, the United States continues to be a major importer of seafood. The US is the world’s third largest consumer of seafood after China and Japan, said the National Oceanic and Atmospheric Administration (NOAA), citing data from the UN Food and Agriculture Organization. Over 90% of the seafood consumed in the US is imported, measured by edible weight. This measure has been rising in recent years, reflecting an increase in imported seafood. A significant portion of this imported seafood is caught by American fishermen, exported overseas for processing, and then reimported to the US.

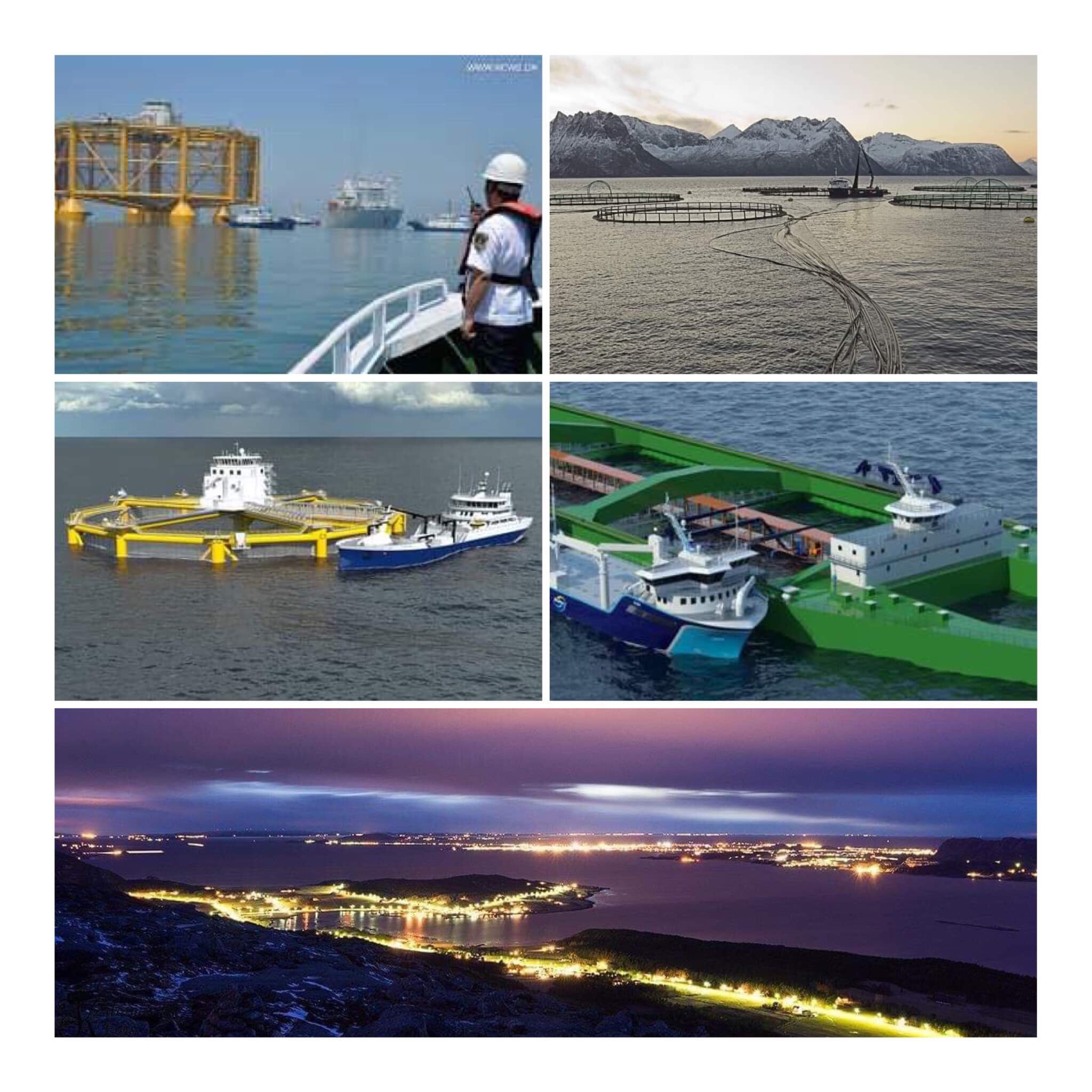

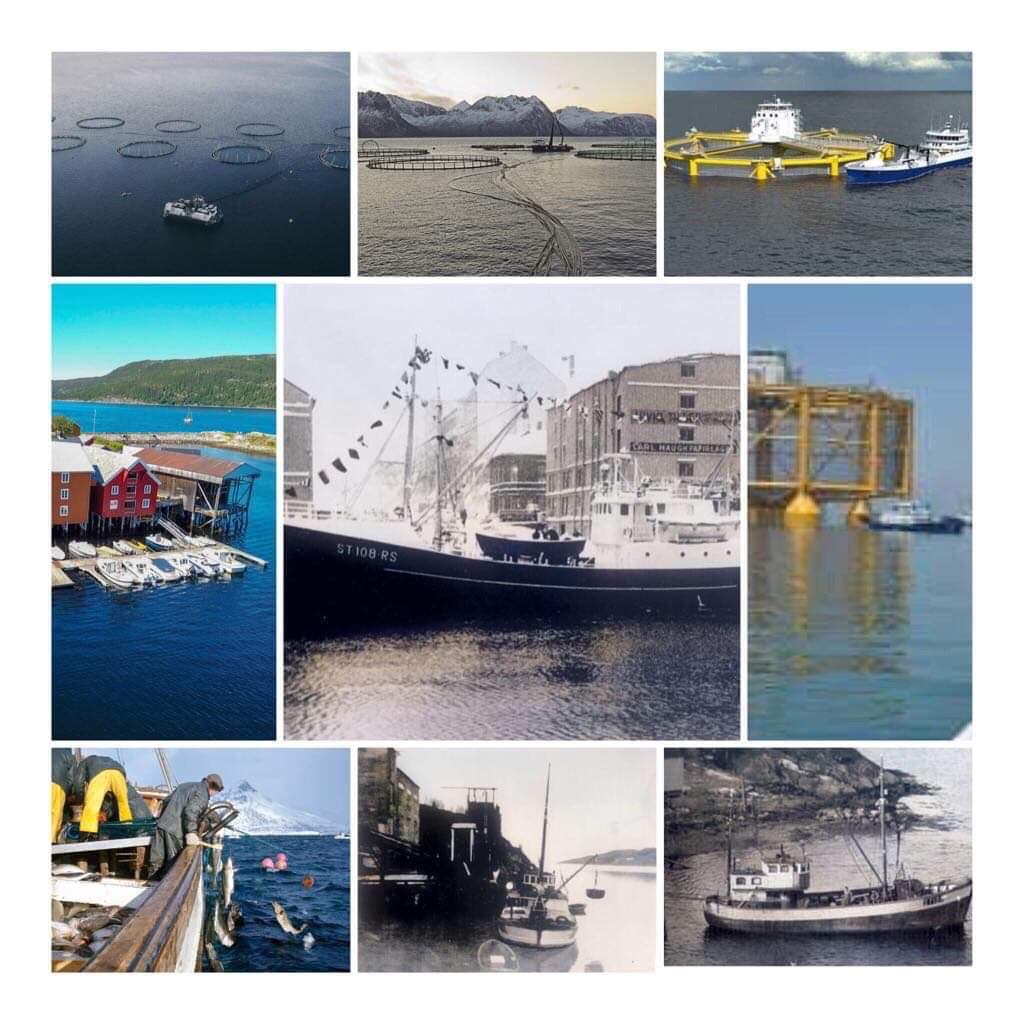

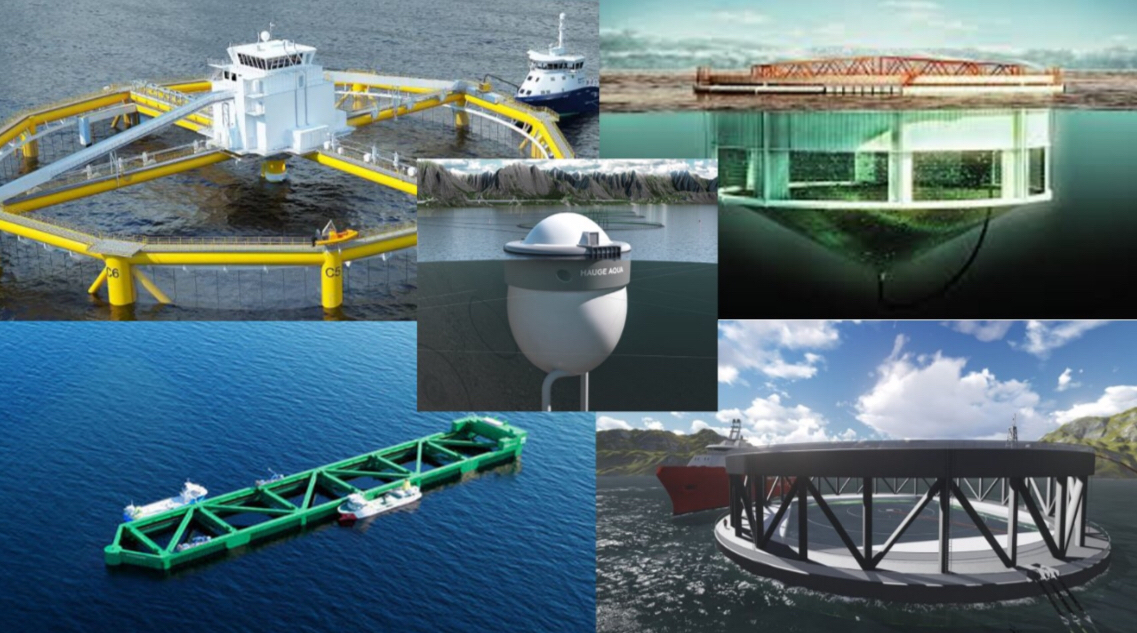

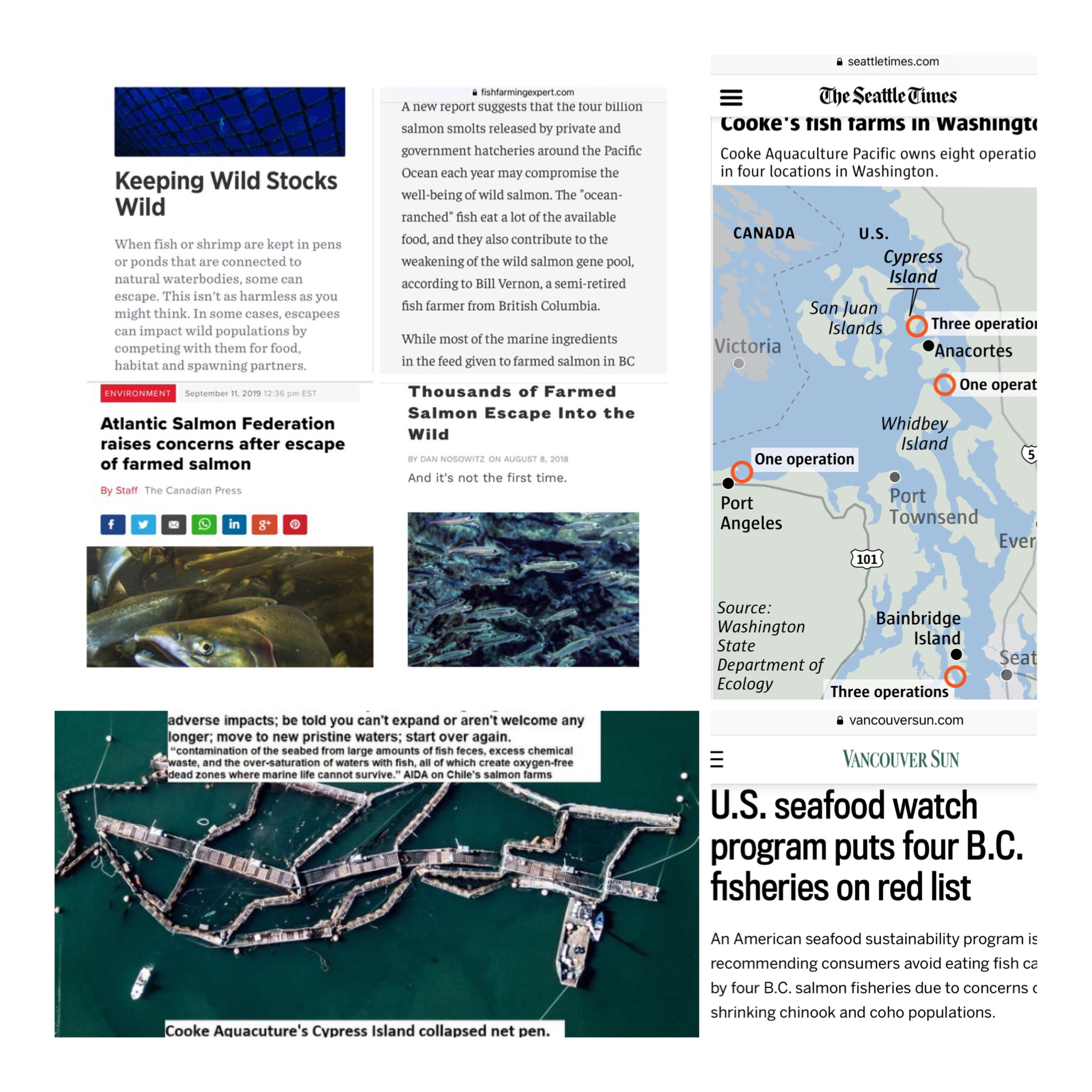

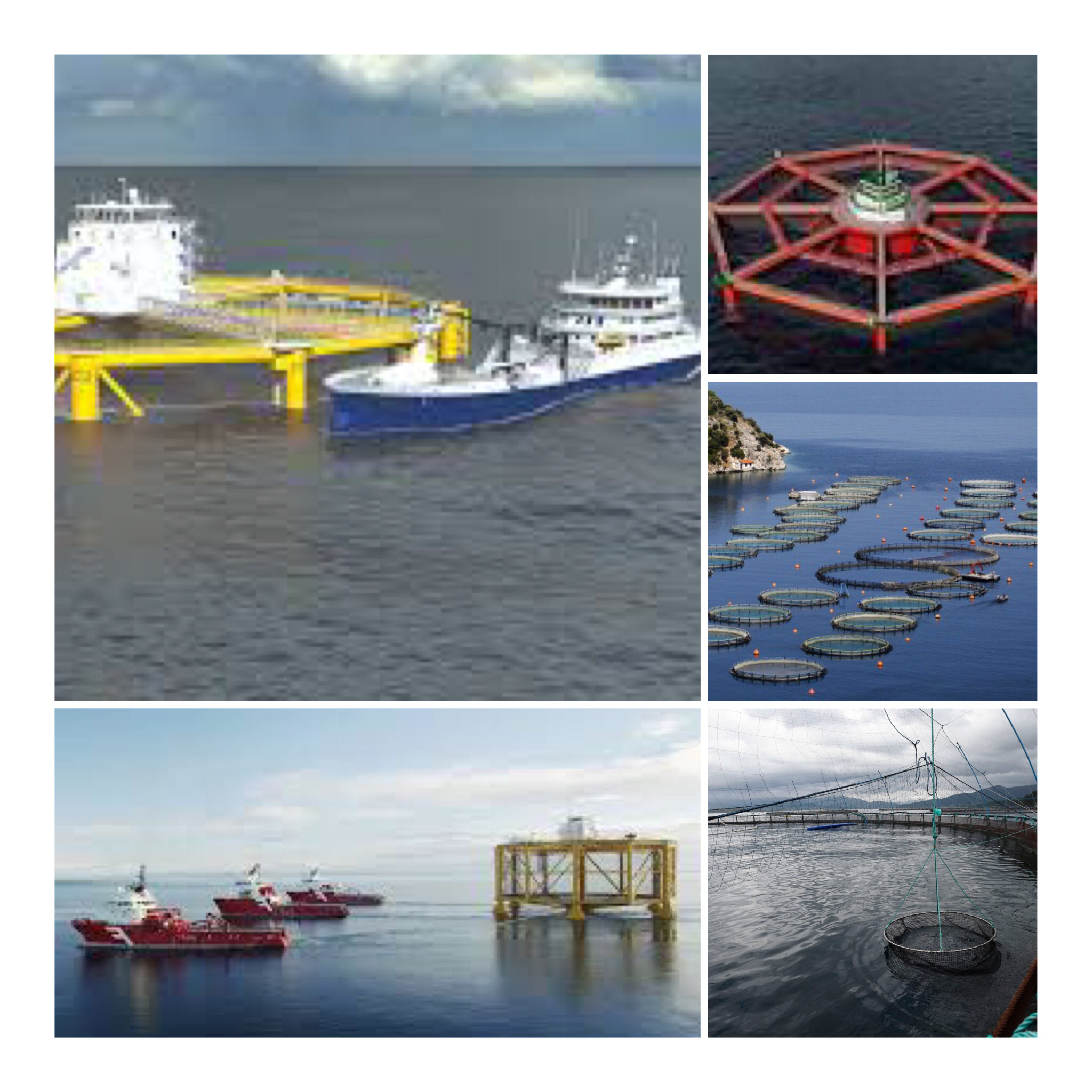

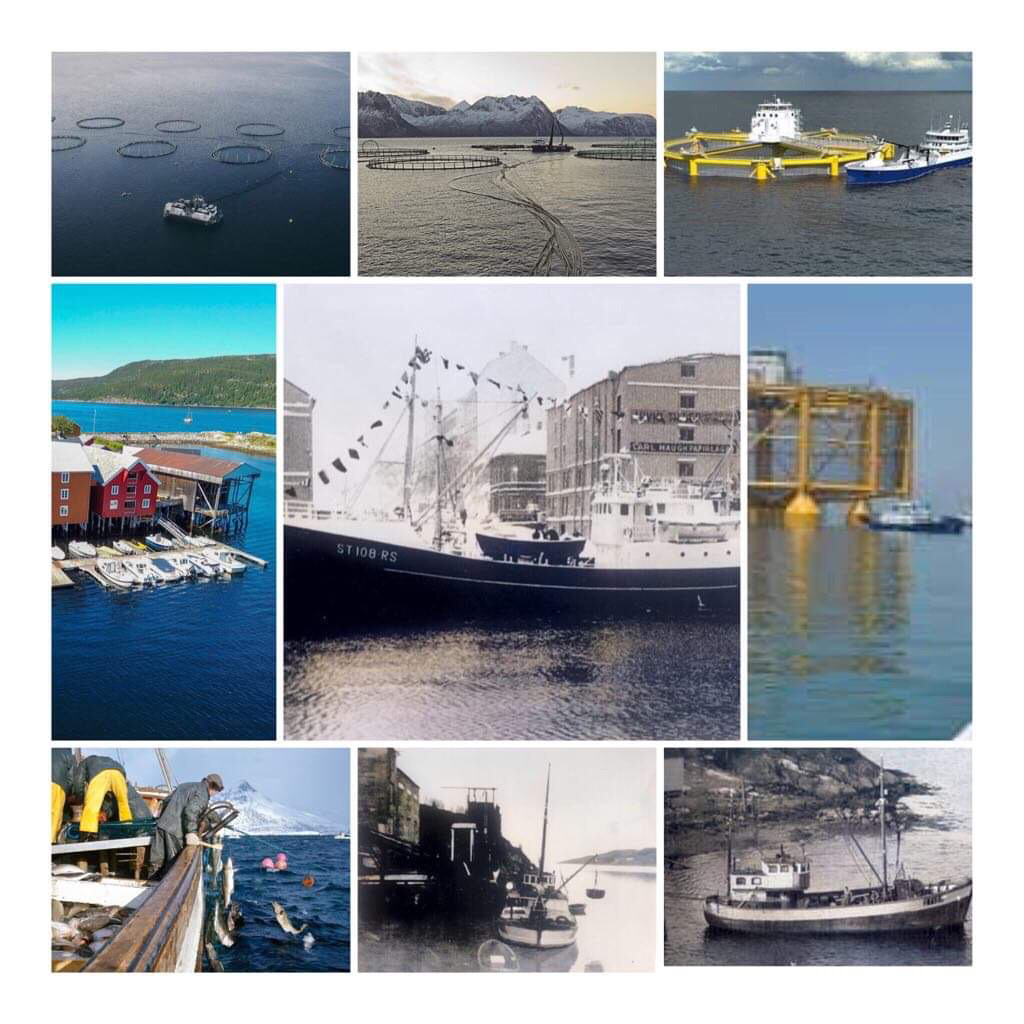

America’s aquaculture industry currently supports only 5% of US seafood demand, producing primarily oysters, clams, mussels, and some finfish, including salmon. Washington and Maine lead the nation in marine finfish farming. Washington, Virginia and Louisiana lead in shellfish farming.

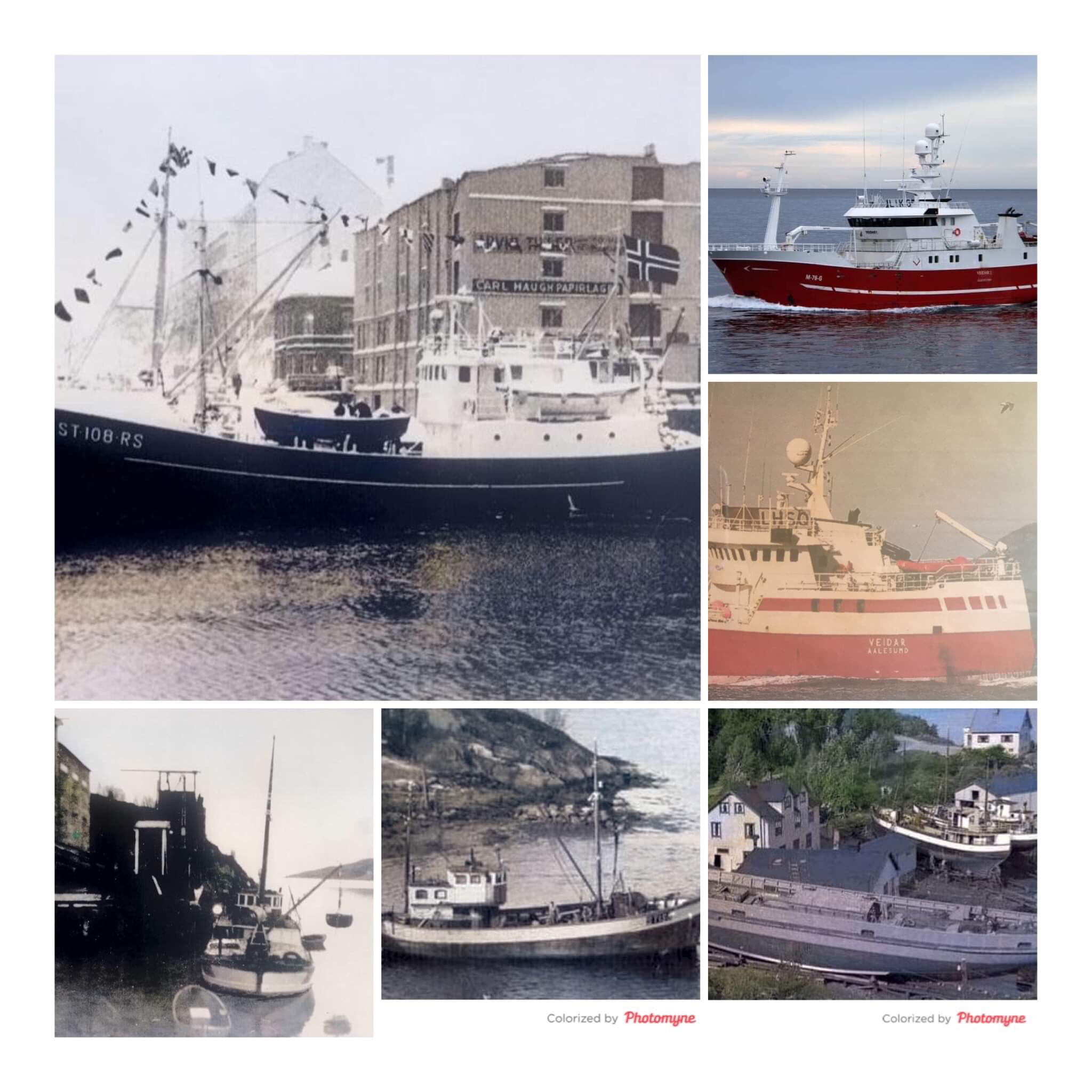

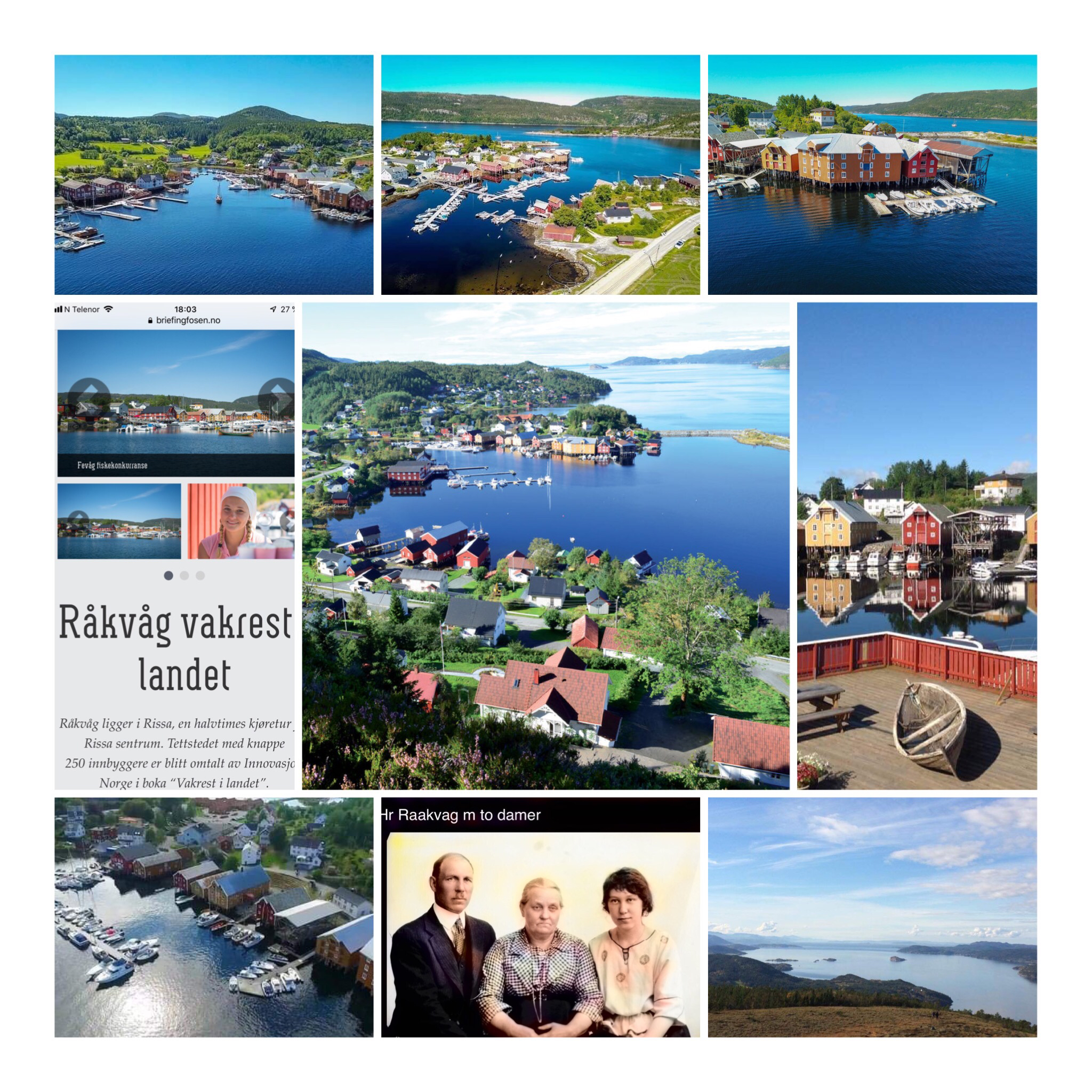

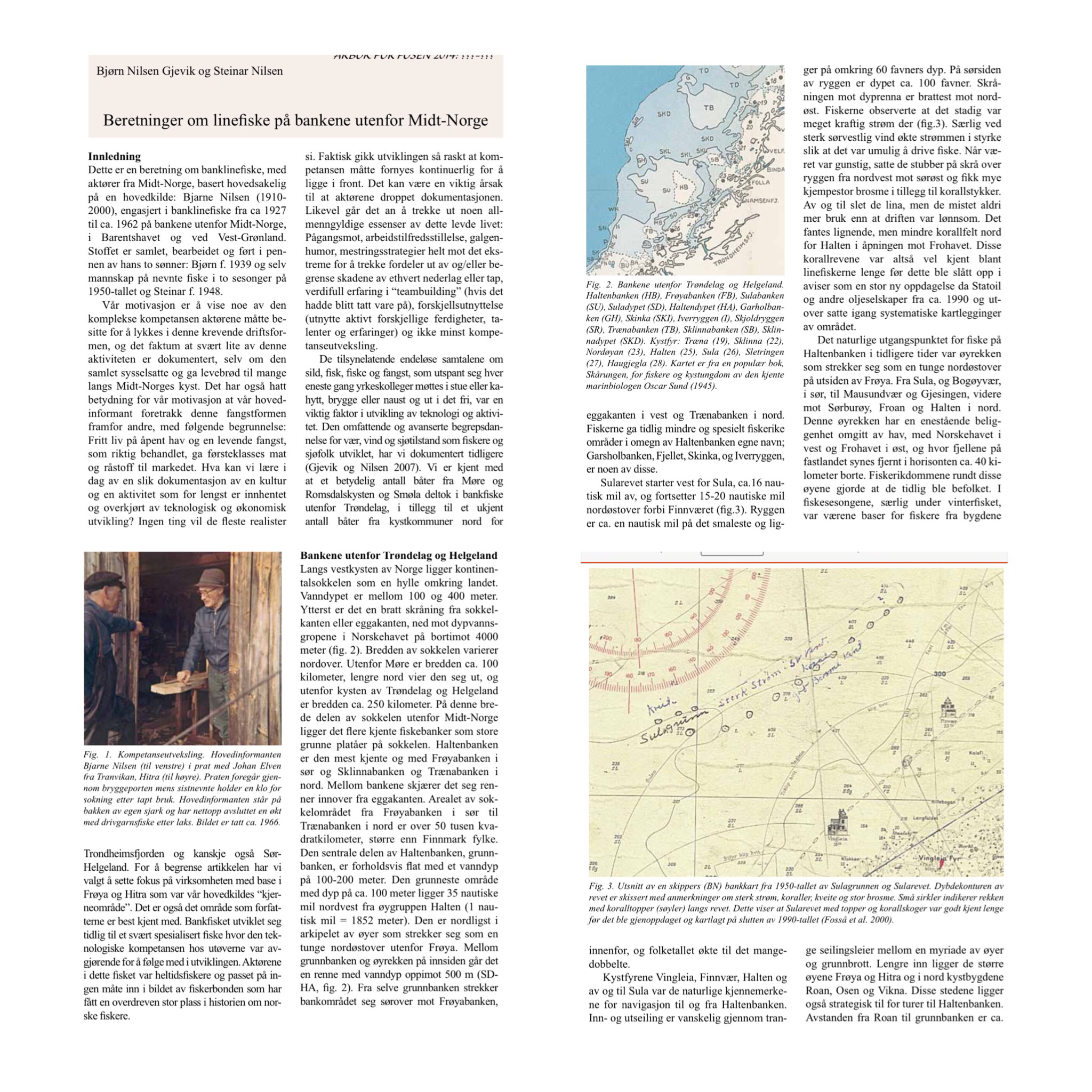

“A big misconception is we can’t get fresh fish here,” said James Iacino, president and CEO of Seattle Fish Co., a third-generation family business in Denver. “We can get it fresh from all the coasts.” “If you’re in San Francisco and eating scallops, those scallops flew over Denver from the East Coast to get to you.” The Iacinos would know. The family has been in the fishmonger business in Colorado since 1918, nowadays supplying some 10 million pounds of seafood a year to Rocky Mountain chefs and grocers. James Iacino, grandson of founder Mose Iacino, opened the doors to their production facility to show what it takes to bring us fresh fish, more than a thousand miles from sea. If you have had a fresh catch in our lovely land-locked state then you are likely to owe that experience in large part to Seattle Fish Company. Don’t let the name fool you, Seattle Fish is a third generation Colorado, family-owned business that began on the platform at Union Station in 1918. The company strives for sustainable practices and in celebration of 100 years as Mile high’s seafood specialist, it is hosting a 100-year Symposium and Anniversary party at the McNichols Civic. innovators, leaders, suppliers, chefs, policymakers, and ambassadors of sustainability. two-day convention to discuss what we can do now to sustain 100 more years of fresh seafood.

As Denver’s food scene develops, so does the city’s desire for great seafood. And while it’s difficult to see our effect on our oceans in comparison to port cities like Seattle, our consumption of seafood majorly impacts the oceans and fish stocks. The best way to consume sustainable food is by eating locally from small farms and ranches, but it’s difficult to consume local fish in a land-locked state such as Colorado. There are a few local aquaculture farms such as Frontier Trout Ranch and Colorado Catch that use sustainable practices to reduce or completely eliminate waste. But these two local farms can only satisfy your trout and striped bass desires. Fortunately, many leaders in the Denver food industry are working with suppliers to increase the availability of sustainable seafood – selecting fish from trusted fishermen and fisheries following ethical practices around the world.

Denver chefs champion sustainable seafood

Landlocked Denver is supplied with sustainable seafood by companies including Seattle Fish Co. and Northeast Seafood, with chefs working to reduce the state's impact on ocean and global fish stocks. The James Beard Foundation's Smart Catch program helps restaurants look into seafood sources, and eateries such as Osaka Ramen strive to educate diners about their seafood. The first step is understanding how seafood can be sustainable in a land-locked area such as Denver.

Ocean Wise defines sustainable seafood as “species that are caught or farmed in a way that ensures the long-term health and stability of that species, as well as the greater marine ecosystem.” Resources such as the Monterey Bay Aquarium’s Seafood Watch give consumers the information they need to consume seafood responsibly. Seafood Watch ranks the sustainability of seafood options for each region in the US (click here for a downloadable guide for Colorado). But this still puts a lot of pressure on consumers to research before purchasing.

Luckily Colorado is home to a few incredible aquaculture farms and seafood suppliers. Based in Denver, both Seattle Fish Co. and Northeast Seafood supply Denver chefs and restaurants with fresh, sustainable seafood.Seattle Fish Co. recently celebrated 100 years of bringing the best fish to our city. In August they hosted a symposium to gather some of the city’s leaders in the seafood industry to discuss the future of Denver’s seafood.

2013, Selling seafood 1,000 miles from the ocean.

Denver's educated populace is also quite keen to jump on the trend towards increased interest in where food comes from, and for seafood chefs, that trend seems to have created a culture of chefs that are curious and anxious to learn about and explore new products.

«We were ready last year,” Figueroa said, describing a somewhat hectic processing situation last year. Inside Seattle Fish Company’s 65,000 square foot plant in its home town of -- surprisingly Denver, Colorado -- on Thursday, chief operating officer Derek Figueroa insists that selling seafood in a city that is 1,000 miles from the ocean is actually not as hard as it looks “for two reasons". “Just because you’re landlocked doesn’t mean you’re not going to have interest in seafood,” Figueroa told Undercurrent News. “And it doesn’t mean you can’t get access to fresh fish. If you have scallops from the east coast and you’re on the west, you have to ship it across all those states.”

«Denver’s a fertile territory and continues to grow,» he said, adding that healthy eating and a high level of education are two key factors to seafood's attractiveness. The city has a highly educated populace -- said to be the most educated in the United States -- and active culture. The state's mere topogrophy nearly forces its inhabitants to take an interest in physical activity. Colorado contains the majority of the "fourteeners" -- mountains boasting peaks at 14,000 feet or higher -- in North American. Denver also recently became the US state with the most sports facilities of any state in the West, according to statistics from HomeToDenver.com. More evidence of the state's high level of active people is the statistic showing its people are the thinnest of any state in the United States.

Today, Iacino and the modern day Seattle Fish Co. are servicing 17 states — sourcing product from all three American coasts and also from countries as far away as Iceland. The mission is not only to help supply Denver’s top restaurants and chefs with a fresh, inspirational product, but also to serve the home cook. If you shop for groceries at King Soopers or Whole Foods in the region you are eating Seattle Fish Co. products.

Each year, Seattle Fish Co. receives and processes more than 7.5 million pounds of seafood in its Denver facility, and supplies Whole Foods, King Soopers, Panzano, Marczyk Fine Foods and others. Since 1918, Seattle Fish Company has been supplying restaurants, hotels, caterers and grocers throughout Denver and the Rocky Mountain area with the finest fresh and frozen seafood. If you shop for groceries at King Soopers or Whole Foods in the region you are eating Seattle Fish Co. products.

Consuming sustainable seafood

Consuming sustainable seafood doesn’t simply mean eating fish that are labeled “best choice” by Seafood Watch, but it also means considering the miles your food has traveled to your plate. Owner of the year-old Bamboo Sushi, Kristofor Lofgren, takes his business’ carbon footprint into serious consideration. After the first location opened in Portland, Bamboo Sushi was named the first certified sustainable sushi restaurant in the world. A part of this honor is due to how Lofgren constructed and operated his restaurants. In addition to using low impact lighting and recycled materials to construct the building, Lofgren’s business plants seagrass – a plant that sequesters carbon at about eight times the rate of trees – to be a carbon-neutral company.

Based in Portland, Bamboo Sushi opened a location in Denver last year. They recognized that Denver is a city where consumers are interested in knowing the story of their food. Named the Sustainable Restaurant Group, Lofgren’s company hopes to set a precedent for sustainability in the restaurant industry – leading by example. Before the Denver location opened, Lofgren worked with local suppliers to ensure they could source from the same trusted fisheries and farms he has worked with for his Portland locations. The owner wanted consistency in his restaurants and commitment to his partnerships, but he also wanted to give Denver chefs an opportunity to discover new sources for their seafood items. “Buying sustainable products, that’s step one, if you want to be a sustainable restaurant,” Lofgren commented. And while that is only the first step, it’s an important one.

Chad Petrone, a wholesaler at Northeast Seafood, explained the risk chefs take by committing to sustainable seafood. Many fishing companies that use sustainable and ethical methods are located in various places around the world. Chefs must be “willing to take the risk,” Petrone explained – not only because it’s more expensive– but because “maybe the fish is not going to show up [on time] because it’s coming from around the world.” Luckily that prospect doesn’t scare chefs – or suppliers – into not investing in sustainable fishing practices. “If I can keep replacing proteins on the menu with more sustainable proteins,” Petrone said, “then we’re improving the planet.” Purchasing from local aquaculture farms can also help eliminate the uncertainty in fish delivery and supplement what fishers can’t provide to suppliers. As aquaculture continues to grow in popularity and necessity, Lofgren insists that “supporting great aquaculture as well is really important to the growth of sustainable farm-raised seafood.”

Colorado’s Aquaculture Farms

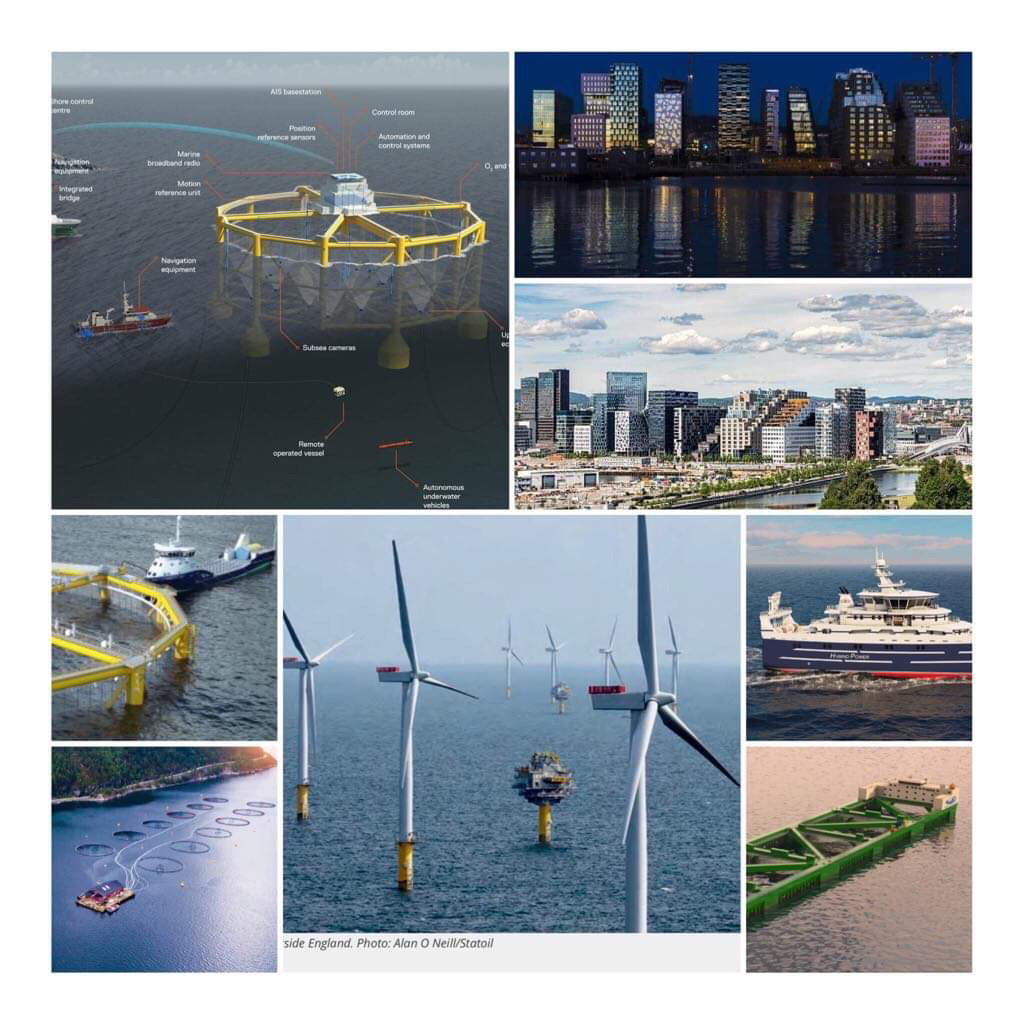

We have some of the country’s most influential and dedicated chefs working towards sustainability in the seafood industry, but Colorado is also home to a few great aquaculture farms. And any expert in the seafood industry will say that the key to sustaining the world’s fish stocks is by supporting sustainable aquaculture. “Wild fisheries are kinda at their capacity,” the JBF Smart Catch Sustainability Director Corey Peet reported. “That then leads to aquaculture which is definitely the fastest growing form of food production – and arguably is the most efficient form of food production.” As the head scientist working with JBF, Peet insists that though aquaculture is important to the future of seafood it has to be done well to truly be an improved and better option than overfishing the oceans.

There are a few local aquaculture farms such as Frontier Trout Ranch and Colorado Catch that use sustainable practices to reduce or completely eliminate waste. But these two local farms can only satisfy your trout and striped bass desires. Fortunately, many leaders in the Denver food industry are working with suppliers to increase the availability of sustainable seafood – selecting fish from trusted fishermen and fisheries following ethical practices around the world. Two Colorado fisheries are doing their best to raise healthy, sustainable fish with little to no impact on the surrounding environment. Both Frontier Trout Ranch and Colorado Catch – raising trout and striped bass respectively – strive to be as sustainable and considerate to the environment as possible. Both Kermit Krantz from Frontier Trout Ranch and Tyler Faucette from Colorado Catch understand that a large part of sustainability is optimizing every resource to its capacity. Both farms source water from a deep well – uncontaminated by water runoff from surrounding farms. Their own runoff, Krantz and Faucette divert to their own farmland, using it as a fertilizer for their other agricultural enterprises.

These innovative practices in raising fish are similar to Kristofer Lofgren’s work in the seafood restaurant industry. The incredible stories of Frontier Trout Ranch and Colorado Catch help sell their sustainable products – making it an attractive alternative to wild caught fish. Faucette understands that there will always be a demand for a wild-caught product. But he also recognizes that the whole world can’t be fed on wild fish. Once the oceans are fished at a sustainable level, “the demand for seafood exceeds what we can catch in wild-caught, so then aquaculture needs to step in and fill the void behind that.”

Other experts in the seafood industry also recognize the importance for farmed fish such as Chad Pettrone from Northeast Seafood. He explained, “we’re on the tipping point where people are starting to realize that farm-raised fish is the way of the future.” When raised well by farmers like Krantz and Faucette, fish farming is one of the most sustainable animal proteins we can consume. Pettrone added, “If we start having the conversation of farm-raised fish versus farm-raised beef versus farm-raised pork and chicken, it’s not even a competition as far as sustainability. The fish is going to come out on top every time.”

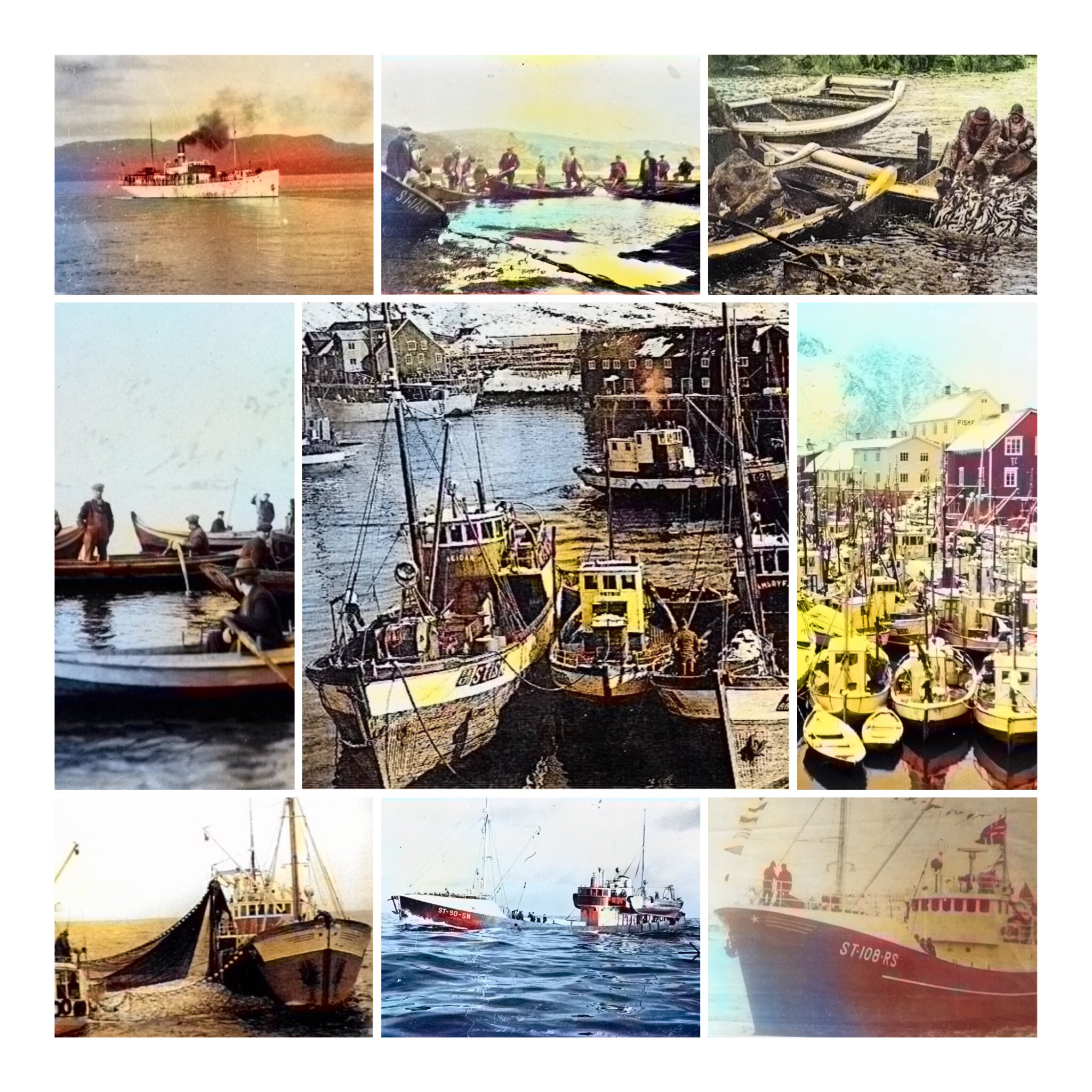

What are some of the biggest changes you’ve seen in the seafood industry since you started?

The biggest changes we’ve seen is how we view our industry regarding preservation of the oceans for future generations. Sustainability; doing the right thing, following the proper procedures, being transparent. Transparency might be the biggest change. It’s been a necessary change. Twenty-five years ago there was little regard for where you got your swordfish or your tunas or how it was harvested. It was just “give me good, fresh fish, let me sell it, I don’t care how you got it.” It’s different now, and it should be.

How was Seattle Fish transporting seafood when you first started compared to now?

We were flying about 75% of our seafood when I started [15 years ago]. I’ve changed that to reverse it. We now truck 75-80% and fly 20-30%. Trucking is a better cold chain and it’s more reliable. We’ve established partnerships with our trucking companies; they care about getting fish delivered on time. Seattle Fish always had a truck coming from of Seattle, Washington, but have since increased our Boston run and added twice a week shipping from Miami and Los Angeles. We now cover all four corners. Sometimes trucking can be the same amount of turn-around as air freight. Once you get it loaded on the plane, they lose it somewhere, ship it to who knows where, then it gets back here. You could have trucked it by then and controlled the cold chain the whole time.

How is being a Director of Purchasing for a land-locked seafood distributor compared to one on the coasts?

Well, the people on the coasts have direct, visual, hands-on contact with the specific items they bring into that particular dock. Our advantage, though, is our location. We can bring in seafood from all corners of the world into middle America on a timely basis. We bring trucks from all four corners of the U.S. Team drivers, carrying a trailer load of fresh seafood arrives in Denver 30-35 hours from port. Our advantage is that we have more access to many varieties of fish from both coasts and the Gulf. You go to some seafood companies in California, and they have ten items they’re selling, their local items. Some of them import other items as we do as an import distributor, but they don’t have any specific advantage over us. Their advantage might be a quicker turnover with just the local fish they have. I think we still have a greater overall advantage sourcing from many regions. We have personally visited docks, gulf coast shrimp and reef fisheries, oyster farms, and fish farms, all over the globe. Seattle Fish Co. is perfectly located in the Rocky Mountain region.

Specialties each week from fishermen

Just because Seattle Fish Co is land-locked doesn’t mean we can’t access the same exotic seafood as anyone else on the coast! With multiple SFC trucks and flights arriving in Denver weekly, we are able to bring in some of the highest quality, and now some of the most exotic, seafood products from all over the globe.

Our Director of Purchasing, Harry Mahleres has made a commitment to our customers to begin sourcing a variety of specialty products from fisherman each week. So far the program has been quite a success and has put some amazing new fish on plates in Colorado.

Each Specialty product is paired with exact sourcing information including the name of the fishing vessel in which the fish was caught, the captain or fisherman’s name, fishing gear and port landed. Weekly emails are being sent to our customers with this sourcing information and up-close pictures of all our specialty products as they land on our dock. Contact your sales rep to begin receiving these ‘Specialty Emails’ today to get your hands on Skate Wings and Cheeks, Sierra Mackerel, Thorny Rockfish, Porgys, and more!

THE PERCEPTION THAT DENVER CAN’T GET GREAT SEAFOOD is a complete myth. On the contrary, Denver is uniquely positioned in the middle of the country, which means we get fish from the East and West Coasts oftentimes more quickly than you can get it on the coast. If you’re eating American red snapper in Portland, for example, that fish flew over Denver to get to you Portlanders. If you’re eating lobster in San Francisco, that lobster flew from Maine and over Denver before it got to San Francisco. All wild salmon comes from Alaska, so if you live in Florida, the wild salmon flew over Denver first. There’s this misconception that if you live on the water, all the fish came out of that water, and that’s not true.

IF IT SWIMS, WE HAVE IT, which means that we source the best products from around the world, and those products get here in the most pristine condition possible – and as quickly as possible. And we hand-cut all of our fish to whatever specifications the chef or grocer needs. We also have one of the largest refrigerated networks in the city. In reality, fish comes from all over the globe, and the fish you’re eating is most likely from somewhere else other than where you live. We are Denver, and we’ve been around longer than anyone else in food service.

Denver is the shortest distance from Los Angeles, Seattle, Boston and Miami – four major seafood ports – and Seattle Fish gets the widest variety of fish and seafood for the shortest distance. That’s a fact. Figueroa said the company’s diverse offerings, which include findings such as locally farmed hybrid striped bass, loch etive steelhead and redfish are playing well with the city’s chefs. “I think chefs like playing around with new species…It’s all about having someone trust us to fill their needs,” Figueroa said. The company also carries a delicacy typically only found in Japan – pollock roe – as well as sardines. Among its hundreds of offerings are Cyprus sea bream to Nantucket scallops to the flavorful redfish it served to Undercurrent during a lunch break from its Thursday plant tour.

The Sea-Pact sustainability consortium

The company is a founding member of Sea Pact, a sustainable seafood alliance that funds fishery improvement projects. Although Seattle Fish places a high regard on sustainability it also aims to give suppliers with room for improvement the chance to improve, a philosophy it shares with the five other companies it co-launched the sustainable seafood consortium Sea Pact with this year. A couple months into Sea Pact’s launch, it has already announced four award recipients for its first round of funding awards to sustainable aquaculture projects.

"We earn our business every day," Derek Figueroa, COO for the company, told Undercurrent News. The company has grown into this fresh-oriented model, considering that when it started, 85% of its sales were frozen. Since the company today ships 85% of its fish fresh, there is little room for error inside the plant or in the procurement or selling departments. That's not the only thing that's changed since the company's inception. In chief operating officer Derek Figueroa's mind, the biggest change has been in the company's involvement in the suppliers themselves, punctuated recently with its co-launch of the sustainability consortium Sea-Pact. "

«When I first came here [in 1990], we bought fish and sold it for the best price we thought we could get out of it,» Figueroa said, "but we've become more stewards of the ocean...it's been an evolution of talking to [sustainability organizations]." Along with a summit hosted in October by the James Beard Foundation, chefs and fish suppliers are continuously working to ensure the city’s access to sustainable seafood. This trend is country-wide, but the landlocked city of Denver is becoming a leader in the national effort.

Chefs, restaurant owners, aquaculture farmers and distributors are committed to reduce Colorado’s impact on our global fish stocks and the ocean’s environment. The family-owned business Seattle Fish Co earned certification from the Marine Stewardship Council, an eco-labeling organization that ensures seafood is traced back to a sustainable fishery. It installed a fluorescent lighting system with motion sensors, a 102.9-kilowatt solar array, and a water reclamation system that saved over 700,000 gallons in its first year.

The MSC (certification by the Marine Stewardship Council)

The MSC is widely recognized as the world’s most credible certification program for wild-caught sustainable seafood and supply chain traceability. The blue MSC ecolabel assures consumers that the fish they are enjoying comes from a sustainable and well-managed fishery that has been independently certified, ensuring that fish populations, and the ecosystems upon which they depend, remain healthy and productive.

Any organization selling or handling MSC certified seafood must ensure that it is correctly labeled and kept separate from other non-certified seafood at all times. This ensures that MSC labeled seafood can be traced back to a sustainable source.

Derek Figueroa, Chief Operating Officer, Seattle Fish Co.: “Seattle Fish was the first in the Rocky Mountain region to be certified by the Marine Stewardship Council as a supplier of sustainable seafood – from catch to cook. Our commitment to sustainability is deeper than ever. The partnership between these committed restaurants, Seattle Fish, and the MSC is an example of our continued focus on responsible sourcing and speaks to our guiding principle, “We Sustainably Feed People”. It’s exciting to work with the MSC and these innovative restaurants to promote sustainable seafood in Colorado.”

Maggie Beaton, MSC commercial manager – Americas, said: “This is an important milestone for the MSC and sustainable seafood in Colorado. The restaurants participating with the MSC are demonstrating to their customers the importance of sustainable seafood. I’m proud of our Colorado partners for taking this bold and important step.”

Denver restaurants Bamboo Sushi, To the Wind Bistro and Pub 17 on Welton Street, together with Boulder’s Wild Standard and Vail’s Terra Bistro, have become the firsts in Colorado to serve Marine Stewardship Council certified seafood and display the blue MSC ecolabel. Coloradans now have five convenient dining options for discovering and experiencing MSC certified sustainable seafood.

Each supplied by Colorado-based Seattle Fish Co., the independent restaurants are artfully preparing a variety of MSC certified seafood options for their customers to enjoy, knowing there will be plenty more for tomorrow. This spring, the Portland, Oregon-based Bamboo Sushi – the first certified-sustainable sushi restaurant in the U.S. – celebrated the opening of its location in Avanti Food & Beverage and plans to open a larger Denver location later this year. Bamboo Sushi founder and CEO Kristofor Lofgren said, “We believe it is imperative to create a restaurant where people can get the freshest and best fish possible, while simultaneously helping to save the oceans and marine life.”

Commenting on To the Wind Bistro’s participation, owners/chefs Royce Oliviera and Leanne Adamson, said: “At our small, neighborhood restaurant, the menu changes daily, but one thing we never want to see go away is fresh seafood. It’s important to us that the fish we prepare for our guests is going to be around for them to enjoy again tomorrow.”

Executive chef John Treusein of Pub 17 on Welton Street in Grand Hyatt Denver noted: “The Marine Stewardship Council is the perfect complement to Hyatt’s culinary concept: Food. Thoughtfully Sourced. Carefully Served, promoting healthy people, healthy communities and a healthy planet.”

Derek Beril, executive chef of Wild Standard explained: “Serving MSC certified seafood is part of our pledge to land and sea. Not only will people get to experience an exciting cuisine, they will also know that they are helping to ensure that the sea and all its treasures are there for coming generations.”

Terra Bistro executive chef Shawn Miller said: “We diligently research the origins, treatment, cultivation, and harvest methods of everything we purchase.” Terra Bistro chef de cuisine Rob Lewis continued, “The heart and soul of Terra Bistro lies in our dedication to forming alliances with farmers, ranchers, fisheries, and suppliers who care for their ingredients and products in accordance with our core values. As a result, our recipes and menu items are developed from a foundation of perfect beginnings.”

Seattle Fish Company’s Green Team

WE’RE CUTTING EDGE WHEN IT COMES TO SEAFOOD, and we reinvest our profits so that we’re always at the top of the innovation ladder. We’re also leaders in sustainability efforts, and while this is an old industry, we’re at the forefront of it. Over the past few years, Seattle Fish‘s Green Team has been instrumental in pioneering progressive green initiatives, and once again, the company has reasons to celebrate its success.

First, Seattle Fish Co. was just recognized as a “Certifiably Green” Colorado business by the Denver Department of Environmental Health. To obtain this level of certification, the Department of Environmental Health assessed Seattle Fish and we then worked with an advisor to prioritize and implement green initiatives, including water conservation and resource management.

In addition, Colorado’s Environmental Leadership Program just awarded Seattle Fish Co. a Silver Partner distinction, a direct result from achieving a clean one-year compliance record and continuing our commitment toward meeting the Gold criteria, where we will implement a fully operational, facility-specific Environment Management System. We are proud to stand next to our fellow businesses with the same goal of a cleaner future.

Sustainable Fisheries Partnership (SFP)

Seattle Fish Co. officially partnered with Sustainable Fisheries Partnership (SFP) this year. SFP will help Seattle Fish Co. assess our sustainability and the two will further partner on specific Fishery Improvement Projects. Sustainable Fisheries Partnership is a non-profit organization that provides strategic and technical guidance to seafood suppliers and producers. One of the principle mechanisms that SFP uses to drive sustainability are the creation and support of Fishery Improvement Projects to address specific problems in the seafood supply chain. Additionally, Sustainable Fisheries Partnership has created a database of fisheries, which contains sustainability assessments of each and is called FishSource.

Green Colorado Awards

SFC was just named one of the ‘50 Colorado Firms on a Greener Path’ by ColoradoBiz Magazineand was is recognized at their Green Colorado Awards, but not by chance. All the credit goes to Seattle Fish Company’s Green Team, which was started in 2010. Being a seafood distributor, our business is dependent on the environment and we have an absolute obligation to engage in responsible operating and purchasing practices, which is why SFC formed the Green Team. The team is comprised of a member from each functional area within the company and serves as ambassadors for the rest of our organization. SFC Green Team works with all stakeholders to promote sustainable business practices both internally and externally. By identifying and sharing innovative methods, offering policy recommendations, and encouraging action, the SFC green team seeks to make a real impact in our practices. To date the ‘SFC Green Team’ has been responsible for our solar panels, our company wide lighting retrofit, water reclamation investment project which has saved 1MM gallons of water last year, and many more sustainable and environmentally focused initiatives

In 2014, Seattle Fish Co. earned two environmental certifications, invested in improved operational practices, increased financial and leverage support for Fishery Improvement Projects, formed a collaboration with Sustainable Fisheries Partnership to make targeted improvements and began a comprehensive self-assessment program that includes collecting data on specific fisheries and sources in an effort to track our purchasing activity.

Sustainable Fisheries Partnership, which works specifically within the supply chain, reiterated that great achievements have been made in sustainability practices, but that it’s crucial to keep asking questions as the industry faces new oceanic challenges, including ocean acidification.

The Aquaculture Stewardship Council (ASC) Chain of Custody Certification

Seattle Fish Co. just earned the Aquaculture Stewardship Council (ASC) Chain of Custody Certification, making us the first chain of custody organization in the state of Colorado and only the 24th to obtain the CoC certification nationally. The ASC in a non-government organization started in 2010 that has set standards for aquaculture and responsible farming. Seattle Fish Co. is dedicated to sustainability and the health of our seafood industry. Having this supplier (CoC) certification allows Seattle Fish Co. to handle, process, and distribute ASC Certified seafood products to our customers. Our customers can trust more than ever that Seattle Fish Co. is the Rocky Mountain Region’s premier supplier for sustainable seafood options.

The UK’s Master Fishmonger Standard

Consumers have the power to change the seafood industry, but they also have to be willing to pay the price and put in the hard work.

“Seafood is a highly valued protein which needs skilled handling and knowledge to match. The different tiers of the Master Fishmonger Standard recognize the journey of the modern fishmonger, regardless of whether the person comes from an independent fishmonger, supermarket or foodservice – the standard is the same for all.” 2018 New standard champions fishmongering, set to bridge consumer knowledge gaps.

As fish consumption gains popularity in health trends, the world’s population is eating seafood at a rate that cannot be sustained by the world’s oceans. The Food and Agriculture Organization of the United Nations (FAO) reported earlier this year that since 1961 the average annual growth in global fish consumption has been twice as high as population growth. To help combat the exponential decrease in fish stocks, consumers should focus on supporting sustainable seafood – both fished and farmed – to ensure the oceans’ stocks return to a healthy level.

It’s easy to make assumptions when purchasing products at the grocery store or selecting from a restaurant’s menu, but there is so much hidden in the seafood industry. The laws of supply and demand mean that what consumers want, consumers get. But they have to know that sometimes what they’re getting isn’t really what they want. If more consumers want a sustainable option when purchasing seafood, restaurants and grocery stores have to ask for that from their suppliers, who in turn have to tell the fisheries and farms that they need to create a sustainable product.

2014: Seattle Fish Co. aims for $100m in sales by 2018

2014: Processor and distributor Seattle Fish Co. is aiming to shift its product mix toward a higher percentage of frozen seafood as it hopes to hit a $100 million annual sales target in coming years. Given the company’s recent performance, Denver looks like a very attractive place to sell seafood.

The company's sales figures have grown by more than 10% each of the past two years, and as the rest of the United States watches its latest per capita seafood consumption numbers drop 4%, Seattle Fish is watching its own product sales volumes grow. Figueroa estimates its volumes are up from 6.5 million pounds last year to 7.5m pounds this year.

With bright projections of 10% sales growth for the next five years, the company is currently preparing to double its capacity by opening up another section of its warehouse, and it is more than prepared to sell more fish. Some of its top sellers are farmed Atlantic salmon, tuna and halibut; but the growth is coming from the full range of its offerings, which number into the hundreds. It is also equally strong in retail and foodservice, which make up equal parts of its sales