GET TO KNOW ME

Hi! I’m Robert Micheal

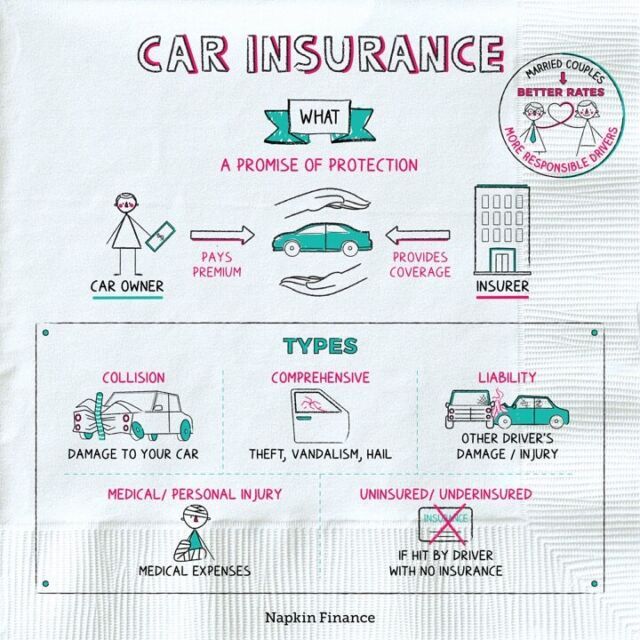

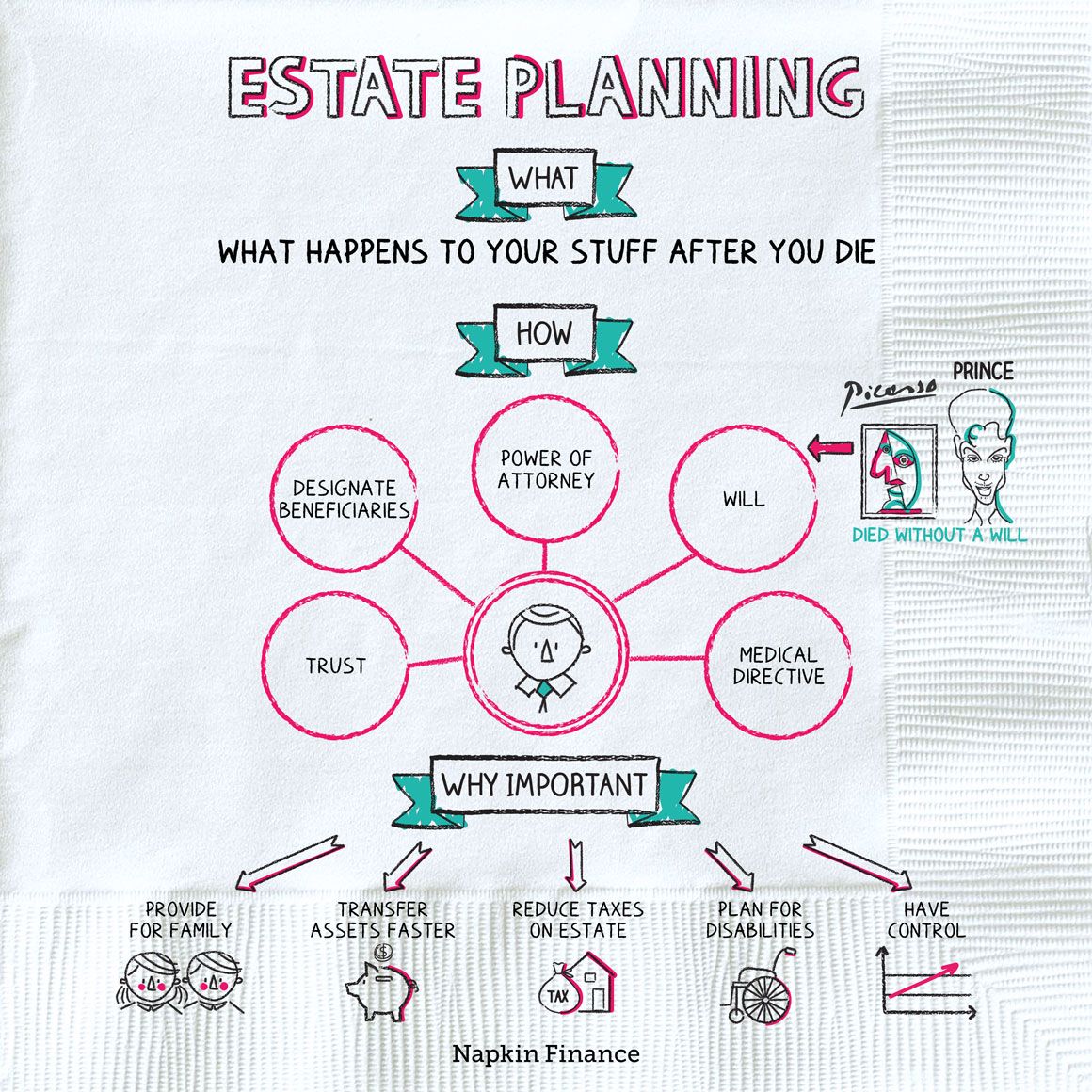

💼 I’m InsuranceMan, Business partner with Manulife Insurance Berhad and Champion Warrior Agency (CWA Group).

🧍🏻I promote and ready to serve my service to you. Buzz me for a comprehensive Insurance 🛡solution for you, your family & your Business and if have any enquiries, feel free to contact me 🤳🏻 0102355980.